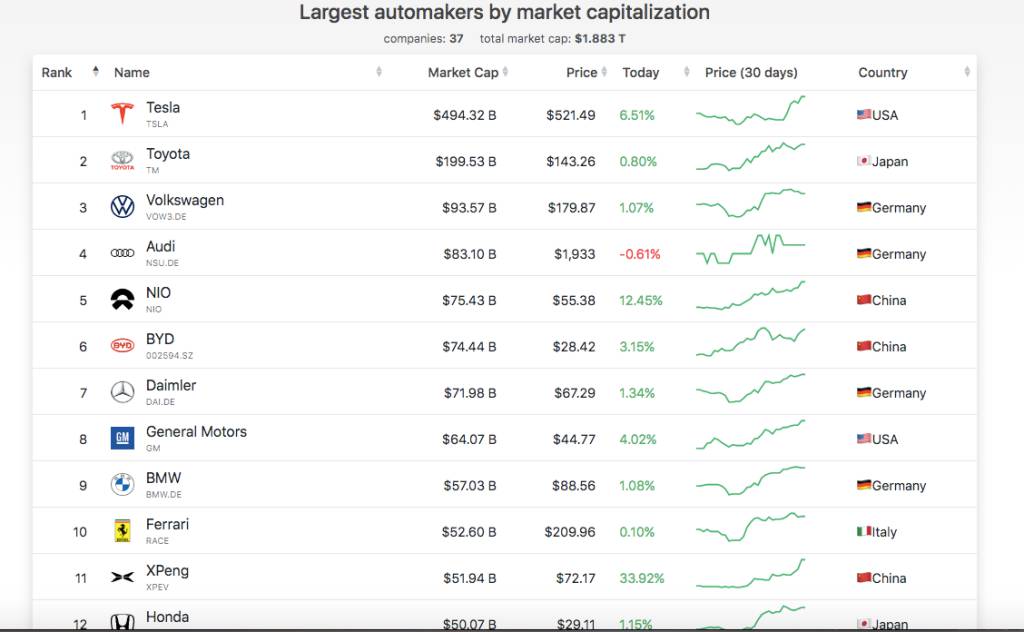

In the last year, we see how the wave of strong growth in Tesla’s stock market is spreading to other automotive groups. Unknown brands for most users, with low production levels, have achieved unprecedented success in their IPO that has allowed names such as NIO, BYD or Xpeng, to climb the list of the brands with the highest capitalization stock market of the world.

As we can see from the list, Tesla continues to increase its difference in the first position, driven by the latest growth experienced since the confirmation of its entry into the SP500. An American brand that had seen how the last sessions had raised the value of its shares to $521, a figure after a split when they reached $1,000. That takes the value of Tesla to $494 million and placed Elon Musk as the second richest man in the world, surpassing Bill Gates.

That is almost 150% more than the second classified, the Japanese giant Toyota, which remains at “just” 199 million dollars of valuation, and a positive march regarding its actions. Something that the third classified cannot say, Volkswagen, which despite being the first group in terms of car sales in 2019, is placed in third place with a value that has suffered as most of the impact of the coronavirus, in a trend that has not allowed it to recover its pre-crisis values.

The Outsiders

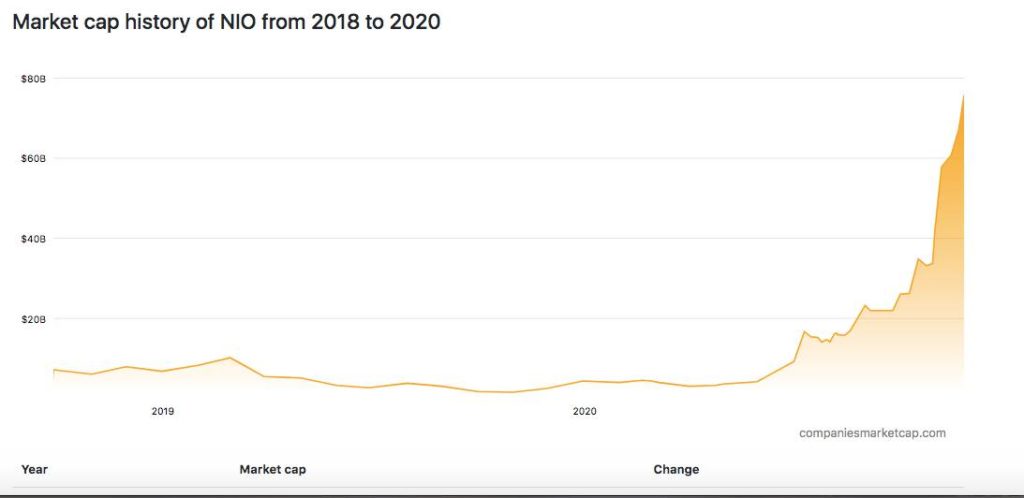

But without a doubt, the great protagonists of these numbers are the new members of the Top. If we look at the top ten, we see how in addition to Tesla, we find a meteoric NIO, which is marching unstoppably in the market.

The Chinese brand, founded in 2014, has managed to climb to 75,430,000 dollars, surpassed in valuation in the stock market the Daimler group, 71,980,000 million, General Motors, 64 million, or BMW, 57,003,000 million dollars.

This has been achieved thanks to a frenzy of value that has grown by 2,600% in just 12 months, and which has seen good production and economic prospects in the last two quarters, which triggered a market value that, for many experts, will continue in 2021.

Striking figures for a manufacturer that achieved a monthly production record last October with 5,000 units per month, accumulating a total production of 26,375 units in 2020. A symbolic figure if we compare it with the numbers of any major manufacturer, but that is 113.7% more than last year at this point, and a trend that investors have bought.

Something that we can extend to another of the most fashionable manufacturers, Xpeng. A brand that shares DNA with NIO, being a Chinese manufacturer, young, independent, and that despite its small production has managed to shoot even more the value of its shares.

According to the closing of Monday, some titles trade at 72.17 dollars, which is 267% more than just a month ago. Something awe-inspiring if we consider that in its IPO, Xpeng barely cost $0.40 a share.

A trend has placed it as the eleventh manufacturer by market value, 51,940,000 million, surpassing Honda, Volvo, Hyundai, etc.

A trend that will possibly mean that in a few days or weeks, Xpeng will overtake Ferrari and BMW and be placed in the Top 10. Something that is followed by other lesser-known names such as Li Auto, in position 16, and that in just one month grown 126%.

Bubble? This is what some analysts indicate, but most of the economic newspapers point to the arrival of new names to the list driven by this trend. Names such as Arcimoto, Electra Meccanica, Arrival, etc., have landed or will soon do so in the stock market as a sign of the enormous growth that the energy sector is experiencing and precisely that related to sustainable mobility.