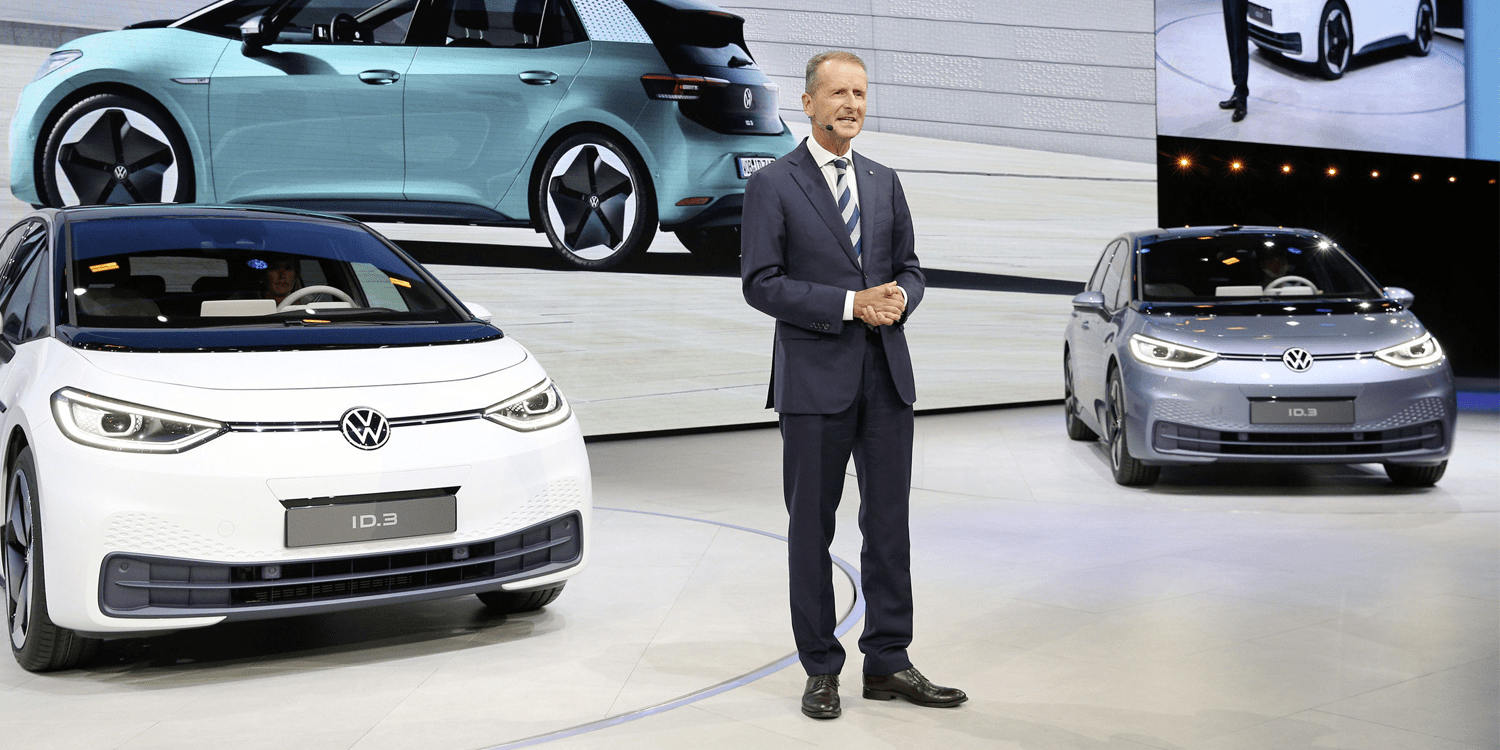

Herbert Diess, CEO of the Volkswagen group, is not satisfied with VW’s valuation compared to Tesla (NASDAQ: TSLA). The multiple and repetitive statements of Diess pushing its managers towards the transformation of the company is a sign of interest and need to be relevant in the new mobility and has a direct consequence in the markets, raising the stock market valuation of the Volkswagen group.

In statements collected by Bloomberg, Bankhaus Metzler analyst Juergen Pieper notes that “there is a loss of power due to the low valuation, about which Diess has complained in the past, and that is a significant disadvantage.” But for Metzler, there is an alternative for the Germans: “A Porsche IPO would be the silver bullet,” declared the analyst.

According to Bloomberg Intelligence, analysts such as Michael Dean calculate that the sports car and SUV maker “could withstand a valuation of 110 billion euros (133 billion dollars) in an initial public offering, approximately 20 billion euros more than Investors Value VW Today.”

The movement weighed in the past would try to replicate the booming stock market exit process of the world’s most annealed car brand, Ferrari.

FCE, which is is now part of Stellantis, was spun off from Ferrari in 2015. Thanks to this move, shares grew 282% on the stock market since its market debut. The Porsche IPO would seek to harness the Stuttgart brand’s historical heritage and appeal to investors, now that the Taycan has set an attractive product with a high image return.

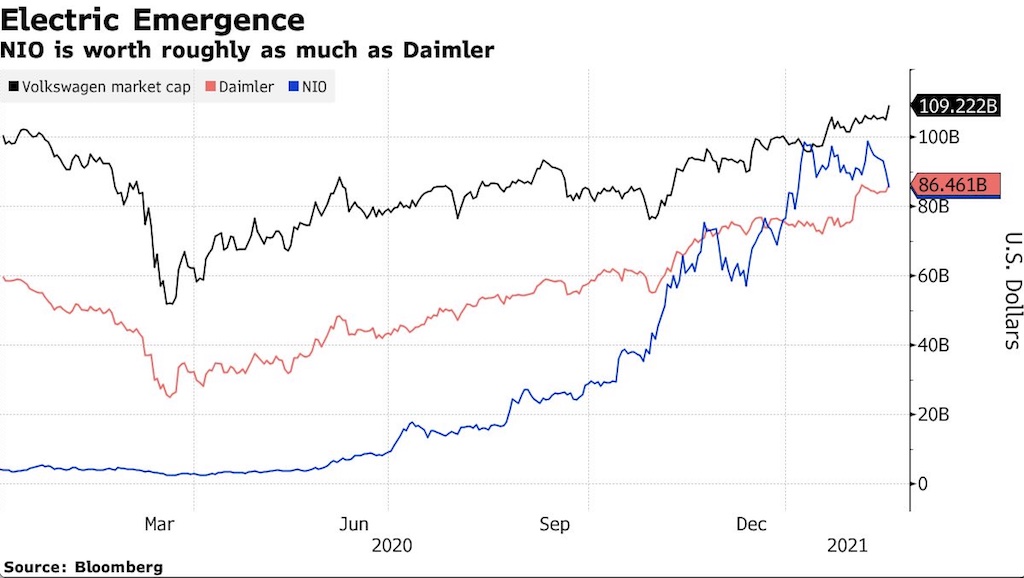

The advantage that its astronomical stock market valuation gives Tesla “is frustrating for traditional car companies. Tesla can use the equity currency to finance growth and grow into its backyard, and that why Tesla is becoming an increasingly annoying name for some manufacturers.