The march of Tesla’s stock price has encouraged other companies to seek financing with its IPO seeking to surf the wave created around the electric car. A few days ago, we learned of the landing of an unknown Chinese brand, Li Auto, which has raised 100 million dollars, which will soon be followed by a more established and popular one such as Xpeng Motor.

This month, Xpeng petitioned regulatory authorities for an initial public offering (IPO) on the New York Stock Exchange. The company intends to sell 85 million shares, priced between $11 and $13 a share, to raise 110 million dollars.

It is to be expected that the Chinese manufacturer will more than achieve its objective. In turn it will confirm the enormous optimism regarding manufacturers, both established and startups, who are betting on the new forms of mobility represented by the march of Tesla shares that have grown 365% so far this year, and with no view of stopping its dynamics in the short term.

Something very striking that collides with demand in markets such as the United States remains stagnant, but experts indicate that it will not last forever. Something that motivates an increasing interest in investments from companies seeking to take advantage of an electric future.

Another of the repercussions of this Xpeng share offering is that it allows it to reinforce the expansion plans in Europe and the United States thanks to the funds and the media coverage that this action will achieve.

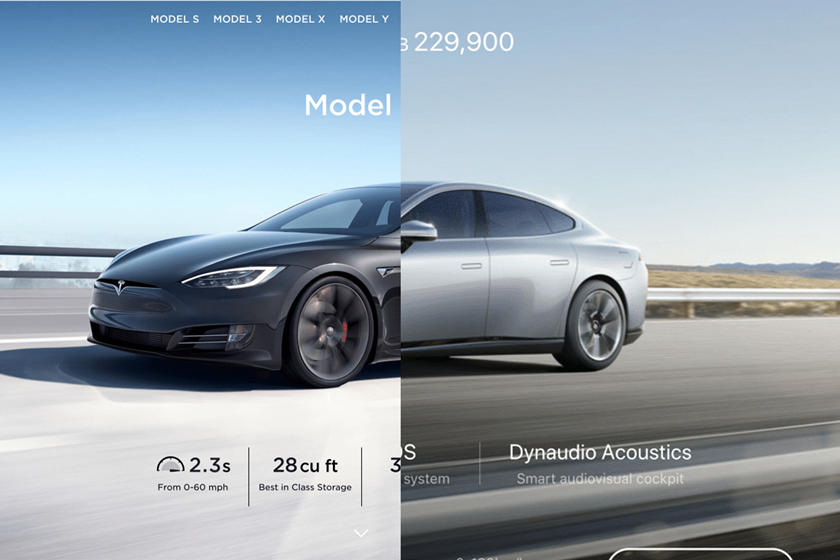

On the left the Tesla page, on the right the Xpeng page.

A Chinese manufacturer that appears to be following in Tesla’s footsteps, including its web site’s design, to the alleged use of its Autopilot code for its autonomous driving system. But with a more competitive pricing philosophy that allows you to launch much cheaper proposals in your home market. He will now have to demonstrate that he is capable of also doing in the West with an arrival that is estimated to take place in 2021.

Will Xpeng be able to replicate Tesla’s success? It is certainly not an easy question as the automotive world is changing radically. In a few months, the large manufacturers will have their new generation proposals, which will mean that when Xpeng expands, it will find a more mature and competitive market, not with the oil, commercial, and technological raft Tesla has grown unstoppably in the last decade.

But what is clear is that there is a great appetite for this type of investment, which can increase optimism around actions that often do not represent the brand’s economic reality, but rather its future potential in a market that, in a few decades, it will undoubtedly be electric.