Although electric cars’ sales are growing, the reality is that their overall market share remains low compared to combustion models. A survey commissioned by the British lubricants company Castrol has sought to determine where the inflection point is at which technology must reach to exploit commercially.

This survey has been carried out among 10,000 people, individuals and fleet managers, who have been asked how far the electric car will have to achieve a niche in the market that allows it to reach at least 50% market share.

A survey was conducted just before the outbreak of the coronavirus crisis. A factor that has been able to modify somewhat the deadlines established in a study that seeks to anticipate the dynamics in some of the leading automotive markets, such as China, France, Germany, India, Japan, Norway, the United Kingdom, and the United States.

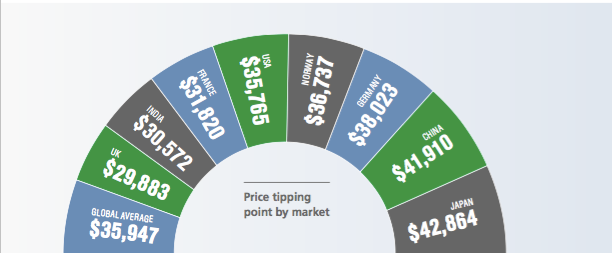

According to the Castrol survey, the turning point and importance for the buyer to start buying an electric car is to achieve a range of 290 miles in a vehicle capable of charging its battery in 31 minutes and with a median price of $36,000.

Curiously, the Castrol report mentions the total cost of ownership of the vehicle, indicating that even though the electric car’s initial price is higher, it compensates for it with its lower operating cost and that it makes our property prices already closely matched.

In the fourth position of the respondents’ priorities, the question of public charging infrastructure has been placed. For 70% of the participants, it is a fundamental element for purchasing a 100% electric car to have a good network of charging points that is easy to use, as is currently the network of gas stations.

Another key is the expansion of the supply of vehicles. The more variety, the easier it will be to convince many users to leap to an electric model. An element that has been ranked as the fifth reason by the participants.

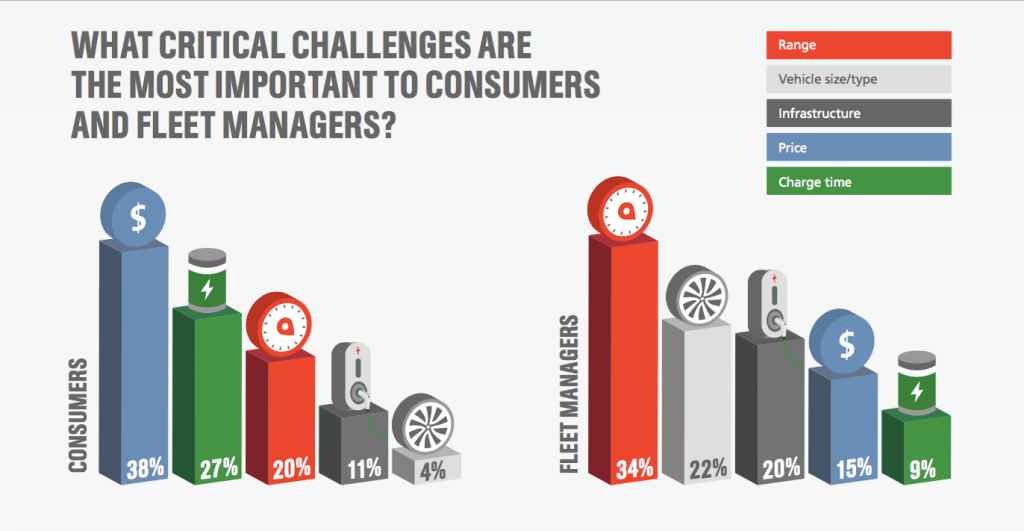

But within the survey itself, there is a difference between individual respondents and fleet managers in terms of priorities. An issue that we can see graphically in the image below and where we see how the priorities change order depending on the buyer’s profile.