Read The Full Article On: Fool

At first glance, it’d be hard to find two companies as little alike as Tesla (NASDAQ:TSLA) and Luckin Coffee (NASDAQ:LK). The electric vehicle specialist and the emerging coffee company obviously offer much different products, and they have headquarters in different countries and focus largely on different market niches. Sure, a Tesla driver in China might have a Luckin Coffee cup in the car’s cup holder, but beyond that, there’s not much common ground.

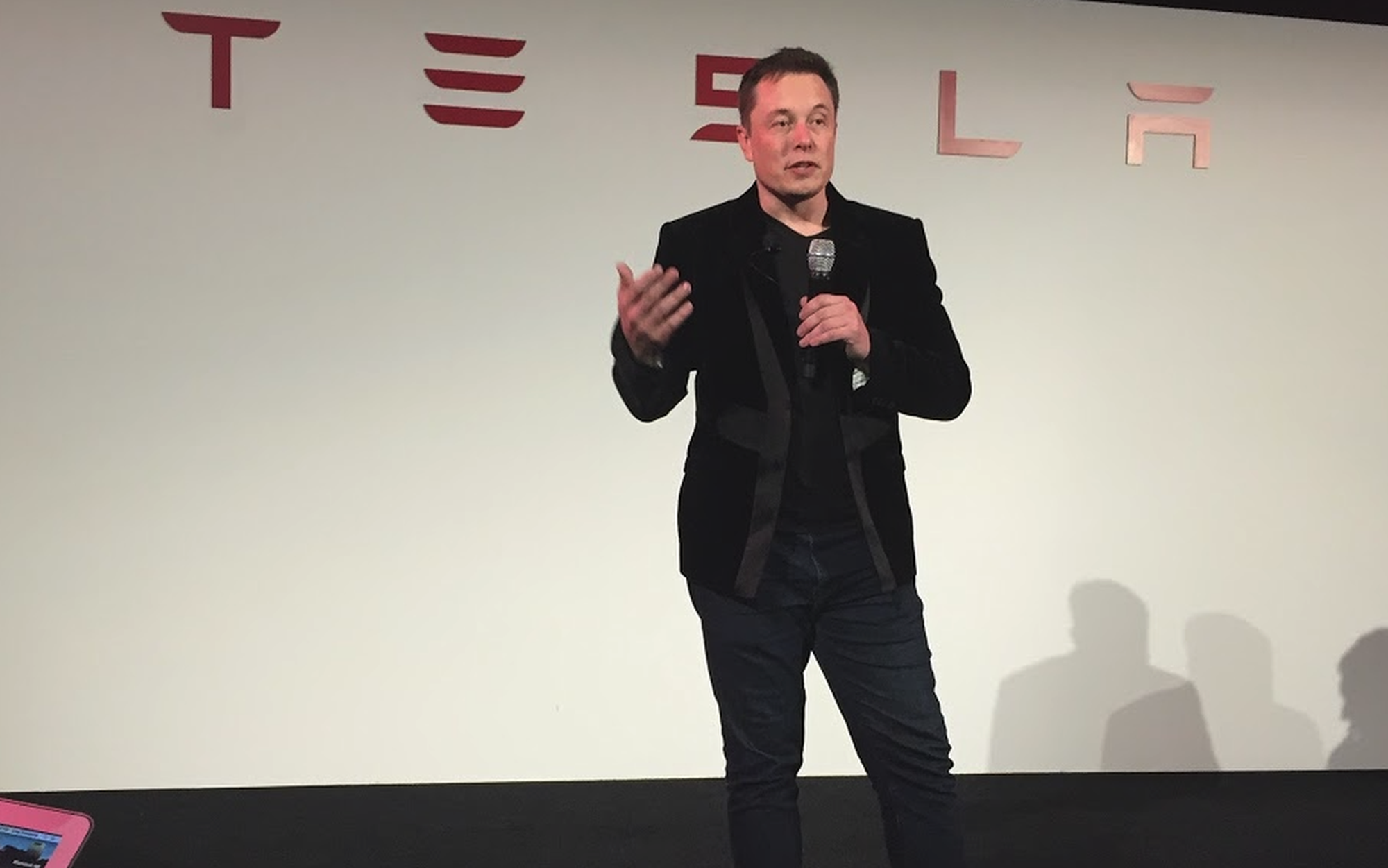

Yet as it turns out, the top executives of Tesla and Luckin do have something in common, and Tesla CEO Elon Musk might be able to learn a lesson from the recent experiences of Luckin CEO Jenny Qian and board chairman Charles Lu. The common ground they share is that they all pledged shares of their respective companies’ stock to take out loans. Those pledges hurt Qian and Lu hard, and while they haven’t bitten Musk yet, the Tesla leader would be wise to take heed before it’s too late.

Here’s what happened to Luckin’s leaders

On April 2, Luckin Coffee disclosed that it was investigating allegations that a team of employees led by COO Jian Liu had fabricated transactions representing a significant portion of the coffee company’s sales during the last nine months of 2019. News of the more than $300 million in fraudulent revenue sent the coffee stock plunging more than 80% after the announcement.

Less than a week later, the Nasdaq Stock Market halted trading in shares of Luckin Coffee, initially for pending news and later as it waited for a response to requests for information from the company. The halt came after reports surfaced that Lu had defaulted on a margin loan for more than $500 million, against which entities controlled both by Lu and by Qian had pledged their shareholdings. Lenders indicated their intent to sell off the stock to repay at least a portion of that outstanding debt, but with Nasdaq trading halted, it’s unclear whether anything has since happened to the pledged stake in Luckin.

Musk’s pledged Tesla shares

Elon Musk has also taken out extensive loans against his Tesla stock holdings. For years, the Tesla CEO has taken minimal cash compensation, instead favoring equity awards. To get cash for his spending needs, Musk has pledged a substantial portion of his Tesla stock to secure personal loans from major financial institutions. As of the end of 2018, which is the most recent date for which Tesla proxy information is available, the CEO had pledged almost 13.4 million of his 38.6 million share position in Tesla as collateral securing those personal loans.

As of February 2020, Musk’s total borrowings amounted to almost $550 million. The loans were spread across three different banks, with an entity controlled by Morgan Stanley carrying the largest portion of the debt.

Why Musk has less to worry about

Admittedly, the risk from pledging shares isn’t as high right now for Musk as it was for Luckin’s corporate leaders. The 13.4 million pledged shares would be worth more than $10 billion at current prices, giving ample security as collateral for loans amounting to just 5% to 6% of their value. Even an 80% drop for Tesla stock would still leave lenders with plenty of margin of safety.

Nevertheless, the threat of having Musk’s stock taken away from him has been very real. Back in 2019, when Tesla faced looming corporate debt and a relatively low stock price, some feared that the CEO’s pledged shares could end up getting called away under the loan provisions at the worst possible time. That would be devastating for the company and its leader alike, and it could jeopardize everything that Musk has done to build Tesla into what it is today.

Be smart about debt

If there’s anything that Musk can learn from Luckin Coffee, it’s this: Don’t rely on using your stock as collateral for significant amounts of debt. If a worst-case scenario happens, then borrowing against your shareholdings leaves you vulnerable to a catastrophic margin call. Despite his aversion to doing so, the prudent thing for Musk to do at this point would be to sell a small portion of his stock in the car company to pay down his debt and hold his Tesla shares free and clear. If only Luckin’s leadership team had heeded that advice and avoided stock-backed debt, then the coffee company might not be in quite the straits that it’s in today.

Something big just happened

I don’t know about you, but I always pay attention when one of the best growth investors in the world gives me a stock tip. Motley Fool co-founder David Gardner and his brother, Motley Fool CEO Tom Gardner, just revealed two brand new stock recommendations. Together, they’ve tripled the stock market’s return over the last 17 years.* And while timing isn’t everything, the history of Tom and David’s stock picks shows that it pays to get in early on their ideas.