ReacThe Full Article On: Investorplace

Though the pandemic has been a net negative for most industries, the burgeoning electric vehicle (EV) market received a tremendous boost thanks to the underlying platform’s superior reliability and lack of maintenance relative to internal combustion cars. But with Tesla (NASDAQ:TSLA) presenting investing newcomers with sticker shock, Nio (NYSE:NIO) presented a much more palatable option. And boy, did Nio stock deliver!

Source: xiaorui / Shutterstock.com

Over the trailing year, shares of the Chinese EV manufacturer gained a whopping 1,352%. Better yet, Nio stock is still going strong this year, up over 18% since January’s opening price. Of course, there’s something to be said about buying into extremely hot momentum – you risk holding the bag. Fundamentally, though, Nio presents an intriguing case for those late to the party.

For one thing, the company has been producing outstanding results, beating the negative implications of the novel coronavirus pandemic. For instance, its third-quarter deliveries increased 154% to 12,206 vehicles, which eclipsed management’s most optimistic guided range. Further, Nio anticipates Q4 deliveries to come in between 16,500 and 17,000 vehicles, more than double the tally from last year’s Q4.

Second, the EV maker’s international ambitions put NIO stock into an even more positive light. That’s because the underlying company has already gained so much traction in its home market. Essentially, additional deliveries will be extra money.

And that’s why the latest rumors about Nio is so intriguing. There is speculation Nio could be making hiring moves to break into the U.S. market.

On the surface, this could be huge for wider EV integration in the U.S. due to competitive pressures. As well, the geopolitical environment – though significantly frayed for obvious reasons – is theoretically a bit more favorable for NIO stock now that Joe Biden is president.

Still, it may be worth taking a breather and thinking rationally about Nio.

Keep Your Strategy Book Open With Nio Stock

Though NIO stock did react positively to the rumors about a possible U.S. entry, it’s probably best not to dwell on it too much. As the new kid on the block, it’s going to be tough for anyone to compete in the mid-to-higher-priced EV market.

Let’s face it – Tesla already has this market segment cornered. By now, the Tesla brand name has significant cachet. Although Nio may have the same in China, I think something will get lost in translation in the U.S.

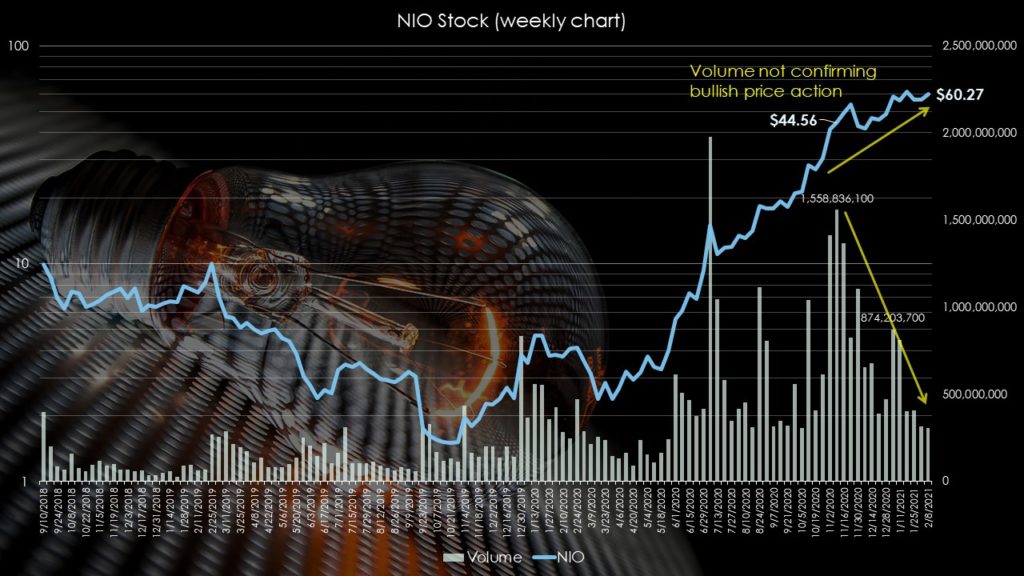

But the bigger concern I have about NIO stock is that the technical picture does not seemingly support a higher move without first incurring a correction. Typically, if the price is rising, you want volume to confirm it, meaning that it too should also rise. When price is rising but volume is declining, technical analysts consider this a bearish signal.

Click to EnlargeSource: Chart by Josh Enomoto

Well, the latter is exactly what’s been going on. When NIO stock averaged $44.56 on a weekly basis, the volume level was 1.56 billion. But as shares steadily increased to $60, volume fell to the 300 million range.

That’s not to say that the technical interpretation is the standalone arbiter of where Nio heads. Certainly, this is not a train you want to short given its incredible popularity. Still, as the price heads higher, the declining volume tells us that fewer people are willing to stake their money on what appears to be an increasingly risky position.

Nio Is Probably Overvalued

As of Feb. 17, NIO stock featured a market capitalization of over $89 billion. In contrast, General Motors (NYSE:GM) only had a $76.5 billion market cap.

I get the argument that GM is basically the Fred Flintstone of the automotive market. On the other hand, Nio represents the burgeoning reality of the sector – it’s a rising juggernaut in already-powerful China running a clean electric platform.

I believe we must think rationally here. General Motors has a long history with both American and international consumers. If an EV company from a country that doesn’t have an automotive track record (not a good one, anyways) can suddenly challenge the top dogs, it goes without saying that an established automaker can at least forward some credible competition.

This isn’t to suggest that Nio is a bad company. Far from it. But the stock is probably due for a healthy correction, giving prospective buyers something to look forward to.