Read The Full Article On: Investorplace

A poor reputation may be a hidden catalyst for FSR stock

By Josh Enomoto, InvestorPlace Contributor Feb 10, 2021, 6:49 am EST

Winning. It’s an American obsession. In the run-up to the 2016 presidential election, then-candidate Donald Trump emphasized that the U.S. doesn’t win anymore. Clearly, this message resonated with voters, securing an unprecedented victory for the celebrity real estate mogul. But this obsession with winning can obscure rational thinking, as I believe is the case with Fisker (NYSE:FSR) and FSR stock.

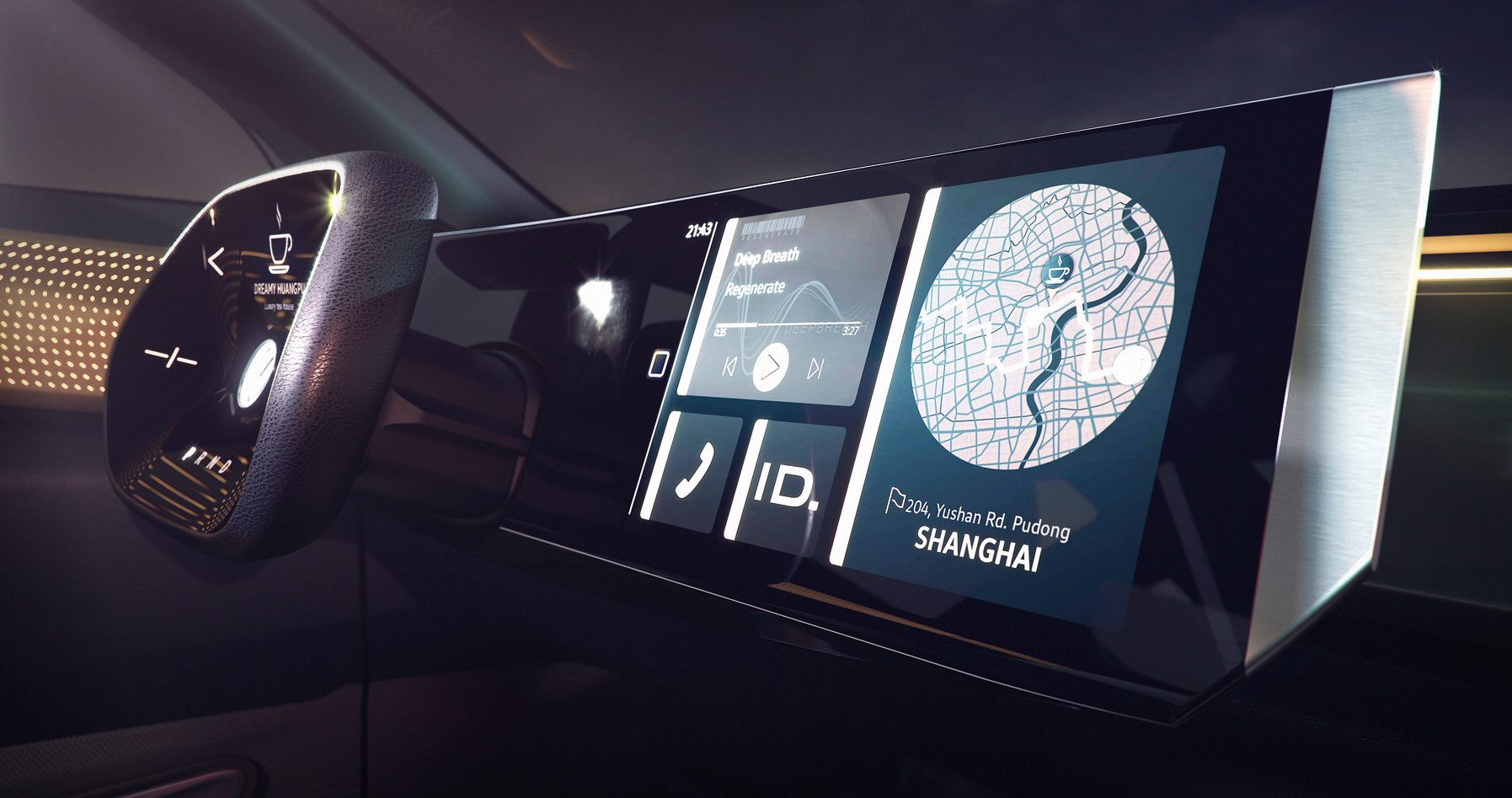

Source: Eric Broder Van Dyke / Shutterstock.com

Just as much as Americans are obsessed with winning, they are equally if not more obsessed with losing – as in doing everything possible to avoid it.

More than likely, this is the reason why President Trump in the run-up to the 2020 election used terms like “loser” to describe his political opponents. Nothing could be worse than being branded as a losing person or entity, as author Francesco Duina might argue.

What does this have to do with FSR stock? Perhaps much more than we care to admit. Under the twisted paradigm of American popular culture that has only gotten more abrasive recently, we have little time for “losers.” Technically (and sadly), that’s what many Americans, consciously or subconsciously, believe about Henrik Fisker.

You see, FSR stock represents the legendary automotive designer’s second crack at creating his own car company. The now-defunct Fisker Automotive launched the Karma, one of the world’s first luxury production plug-in hybrid vehicles. Typical of a Fisker-designed vehicle, the Karma stood out amid a sea of automotive plagiarism.

However, design alone doesn’t pay the bills – the underlying fundamentals must be at least be adequate. Of course, this is where the first Fisker company came up short. While this past history might not have mattered in another culture, in our winning-obsessed America, it wasn’t great optics for FSR stock.

I believe it’s time for a rethink.

Why the Second Time Could Be the Charm for FSR Stock

First off, failure happens to all of us. Today, we celebrate the human miracle that is Tampa Bay Buccaneers quarterback Tom Brady. As a seven-time Super Bowl champion, he has more rings than any other NFL franchise. That’s absolutely nuts. And it’s no wonder everyone (well, most everyone) loves Brady. He’s a proven winner.

But we tend to forget that nobody expected him to be so great out of college. As a sixth-round draft pick, several other QBs were drafted ahead of Brady. He never forgot it. Failure and rejection drove him to profound success.

In similar fashion, Fisker could end up as that surprise champion in waiting, driving up FSR stock over the long run.

First, Henrik Fisker had the good business sense (and supreme confidence) to keep the rights to his namesake trademark. Though a subtle detail, this to me indicates he knows his market value as a designer of distinguished automobiles, which should serve FSR stock well in the years ahead.

A few years ago, The Economic Times reported that Indian car buyers were increasingly considering exterior looks as part of their purchasing decision. In other words, as discretionary income rises, so too does the desire to purchase products of distinction or refinement.

Go ahead and compare the Fisker Ocean SUV to the ho-hum SUVs in the market today. This is a speculative investment worth putting on your radar.

Second, the original Fisker’s failure was tied to business matters, not to the design element nor the Karma itself. Moving forward with Fisker 2.0, Fisker the designer has integrated business smarts into his company. As InvestorPlace contributor Larry Sullivan pointed out, this second go-around will outsource manufacturing to specialists in the field.

More importantly, the pricing for the Ocean makes sense. Starting at just under $35,000, it will feed Americans’ love affair with SUVs at a price rival Tesla(NASDAQ:TSLA) apparently can’t match.

A Risky but Attractive EV Wager

Of course, without the Ocean SUV rolling off the production floor – an event that’s about two years away – FSR stock is a speculative wager. I’m not going to mince my words. It’s always risky when you’re dealing with these aspirational investments.

However, with so many EV plays out there – many of them in my opinion questionable – I believe FSR stock deserves a fair shake. It might not be getting it, though, in part because of our culture. We tend to shun failure as if it’s permanently contagious. It’s not.

If I’m being honest, I like that Henrik Fisker failed and yet is out there making another go at it. That shows confidence and ambition. And we all know that Fisker is incredibly talented, which should translate into a person of generally high intellect. Presumably, he’s learned his lesson, this time going with what works and avoiding what doesn’t.

I don’t know about you but to me, this sounds like a wager worth placing.