Read The Full Article On: Markets

shares launched as much as 7% higher in early Wednesday trading after the automaker announced a five-for-one stock split set for later this month.

Every Tesla shareholder will receive four additional shares for every share they currently own when trading ends on August 28, the company said in a Tuesday afternoon press release. The value of all five shares will equal the stock’s pre-split closing price from that same day. At Tuesday’s closing level, the newly split shares would be worth roughly $274 each.

Trading of Tesla shares on a split-adjusted basis will begin on August 31. The split alone won’t change the automaker’s market cap. Yet cutting the barrier to entry for smaller investors to buy in could boost Tesla’s share price.

Apple announced a four-for-one stock split in July and promptly rallied as retail traders rushed to the stock. Tesla is following the iPhone maker’s lead and should benefit from it, Wedbush analyst Dan Ives said in a Wednesday note.

“For Tesla given its strong retail base and growing appetite among investors around the story/overall [electric vehicle] demand, we believe this is a smart strategic move at the right time for the board to make,” Ives said.

The late-August split could serve as the latest booster for Tesla’s already-lofty share price. The stock is up about 230% year-to-date, with investors’ excitement growing around earnings beats, potential inclusion to the S&P 500, and strong vehicle deliveries amid the coronavirus pandemic. Tesla’s current market cap establishes it as one of the world’s most valuable automakers, despite its producing far fewer vehicles than legacy names such as VW or Toyota.

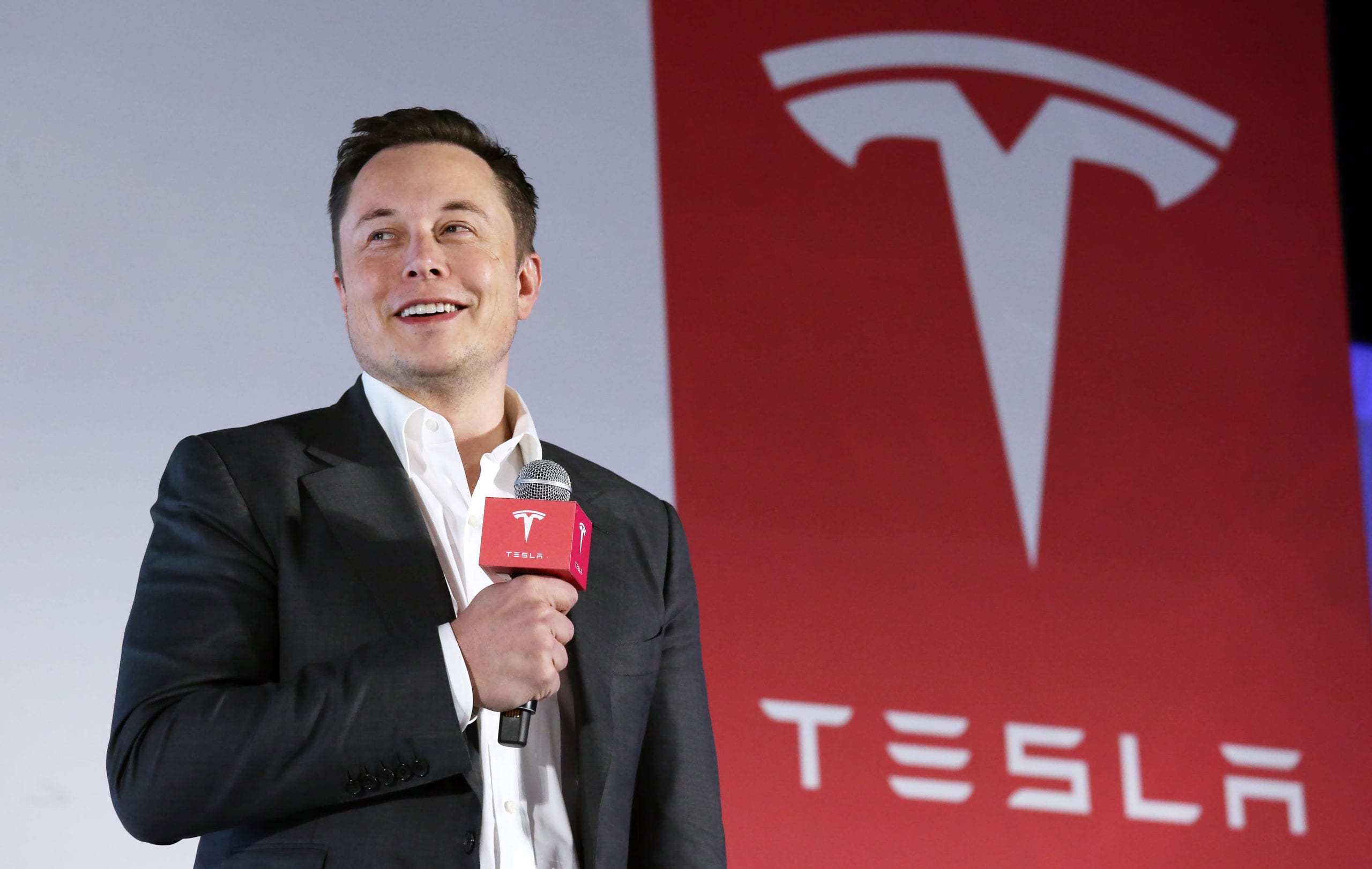

CEO Elon Musk hinted at the split on June 30, replying to a Twitter user that a stock split would be “worth discussing” at the company’s annual shareholders meeting. Tuesday’s split announcement likely surprised some, as the meeting is scheduled for late September.

Tesla closed at $1,374.39 per share on Tuesday.