The lithium battery production industry has seen business volume soar in the past five years. A sign of the enormous speed that the sector is achieving, driven mainly by demand from the transport sector thanks to the boost in electrification.

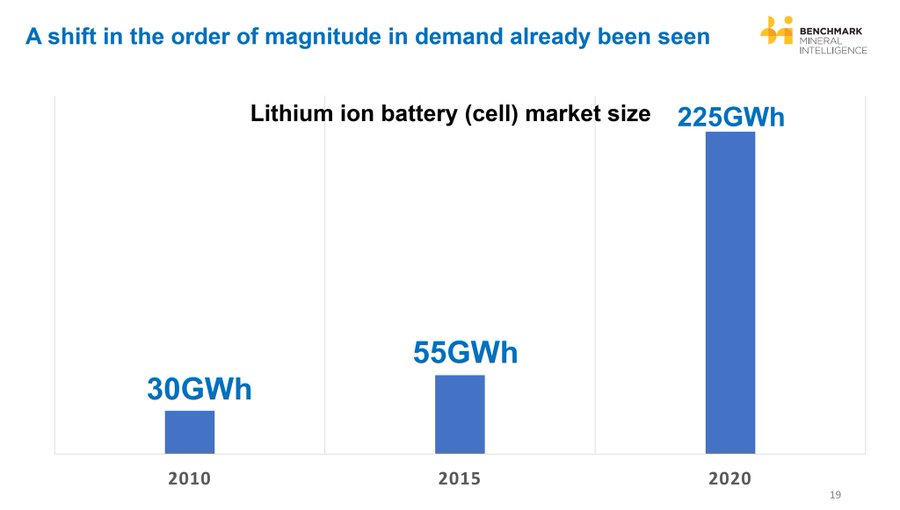

As we can see in the graph, world capacity has seen its figures jump from 30 GWh in 2010, to 55 GWh in 2015, definitively exploiting this 2020, where 225 GWh of annual capacity will be reached.

Figures that will fall short given the many initiatives underway that work to build large factories to meet the demand of sectors such as the electric car. We will see the start-up or expansion of factories by new manufacturers, as well as the initiatives of traditional groups in their quest to find an alternative to dependence on Asian battery manufacturers.

For example, we highlight the initiative of the oil company Total, which, through its subsidiary Saft and in collaboration with the French group PSA, built two battery factories with 32 GWh each. Something that will entail an investment of between 5,000 and 6,000 million dollars, and also means exceeding the global capacity of lithium batteries in 2015. And that with a single initiative.

This will have the consequence that in the next five years, we could see how world capacity will multiply by four or five, bringing the annual figure to around 900 GWh.

To get an idea of this figure, we can make a calculation in battery packs for electric vehicles if we used the total production. Meaning in 2025 we would have the capacity for some 14 million 64 kWh batteries each year.

Of course, part of this capacity will be destined for consumer electronics. Within transport, it will have to be divided between the different sectors: cars, industrials, heavy traffic, public transportation, stationary storage, etc.

But the point is we can see how the global production capacity of batteries accelerates in an unstoppable way. Something that will allow putting an increasing number of electric vehicles on the road, at the same time that the economy of scale is triggered, which will reduce the cost kWh. A critical factor that will help to continue increasing investments.

A trend that also serves as an example of the industrial potential of a sector that has been left in the hands of Korean, Chinese, and Japanese manufacturers and which must be part of the energy strategy of countries in the queue in production. But also, which wants to advance so that the manufacture of an increasing number occurs within its borders.