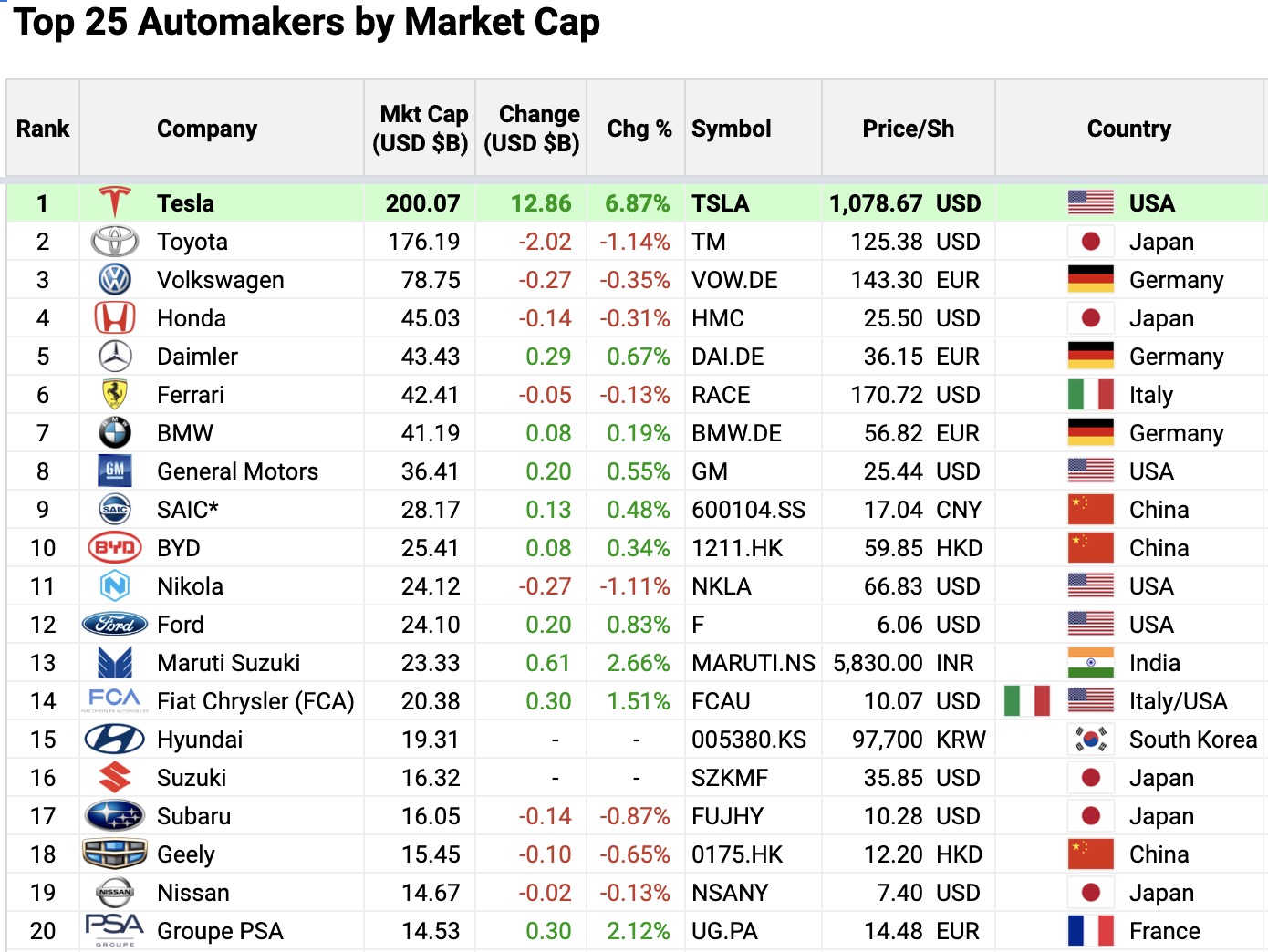

Earlier this month, Tesla became the worlds most valuable automaker when its stock price pushed to over $1,000 per share, beating Toyota. While investors tried to decipher how grim the second quarter would be for Tesla, stock prices dropped over the last few weeks along with the rest of the auto industry that is suffering from massive losses. However, over the last two days, Tesla’s stock has climbed to an all-time high of $1,085 per share. With a market capitalization of $200 billion, the all-time high puts Tesla ahead of Toyota again as the most valuable automaker in the world.

Investors and Wall Street were expecting a significant loss in Q2. However, the price surge came after comments from Tesla CEO Elon Musk saying he believes breaking even is possible in Q2, even with only a couple days left. Analysts are left now to update their predictions while shareholders are relishing the possibility of Tesla entering the S&P500. One of the requirements to qualify for the S&P500 is for a company to have reported earnings in the most recent quarter, as well as over the four most recent quarters. Meaning if Tesla makes even one cent of profit this quarter, technically it will qualify.