Read The Full Article On: Cleanenergy

As the world reels from the public health impacts of the pandemic and economic uncertainty loom large, stories about an impending electric vehicle market crash provide click-bait, little more. It is no longer a matter of if but when and where EVs will dominate auto markets.Stan Cross | June 26, 2020 | Clean Transportation, Electric Vehicles, Energy Policy

The ability of electric vehicles (EVs) to consistently deliver a superior driving experience across brands and models is the cornerstone of the technology’s success disrupting a centuries-old oil-dependent car industry.

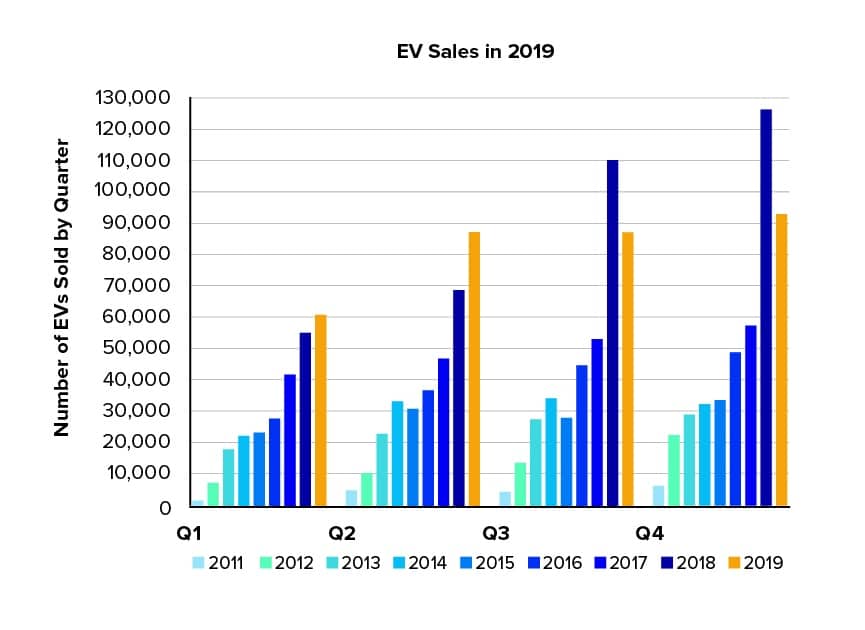

2019 saw 10% year-over-year growth in the global EV market, with 2.2 million EVs sold, representing 2.5% of market share, or 1 in every 40 passenger vehicles. In the U.S., 2019 sales remained strong though lower than Q3 and Q4 2018 when initial Tesla Model 3 deliveries surged.

In 2020, COVID-19 and the economic recession is hitting the U.S. auto industry hard. Sales of all vehicles are down. The passenger car market dropped 45% year-over-year in April and is down 29% year-to-date. In comparison, EV sales dropped only 30% in April and are down only 12% year-to-date, despite record low gas prices.

By May 2020, EVs had already rebounded with 4,000 more EVs sold than May 2019. EVs are proving to be more resilient to global market volatility than gas cars because EVs deliver a superior driving experience:

- Performance is better, faster, quieter.

- Total cost of ownership is lower, saving drivers upwards of $1,300/year

- Zero tailpipe emissions improve public health, no small benefit amidst a pandemic.

- Driving on electricity emits 54% fewer CO2 emissions per mile than the average gas car.

- Charging at home instead of filling up at the pump is more convenient (another boon during a pandemic).

- Driving on regulated domestic electricity instead of volatile global oil enhances energy security.

By 2022, there will be over 500 different EV models available globally. Bloomberg New Energy Finance forecasts global EV sales will grow from 1.7 million in 2020 to 8.5 million in 2025, 26 million in 2030, and 54 million in 2040, representing 58% of anticipated new car sales. Three accelerants will fuel this growth:

- Economics: battery prices have and continue to fall precipitously, enabling EVs to achieve cost parity with equivalent gas cars soon.

- Fleets: companies and cities are converting fleets, which leads to bulk purchases that drive up sales numbers and further drive down prices.

- Technology: Batteries keep getting better, leading to greater efficiency, extended range, and faster charge times.

AUTOMAKERS ARE BETTING ON EVS TO WIN

In 2020, for the first time, more new EV models are entering the market than new gas car models. That tells us where auto manufacturers’ Research & Development dollars are going. Looking forward, the automakers show no signs of slowing down. At least ten new models are due out in 2021 from auto giants like GM and Ford to niche manufacturers like Tesla and newcomer Rivian. There is notable action across brands:

Tesla sets the EV market pace; in 2019, 78% of U.S. all-electric EV sales were Teslas. Tesla is opening a new manufacturing plant in Austin, TX, coming off its first-ever profitable first quarter that included the launch of the Model Y SUV crossover. The Cybertruck pickup is due out next year.

GM plans to introduce at least 20 new all-electric vehicles by 2023, including sedans, trucks, and crossovers. First up, the Cadillac Lyriq and Hummer EV built on GM’s new Ultium propulsion system delivering upwards of 400-mile range and 1,000 horsepower. On a recent call with media, Ken Morris, GM’s VP for autonomous and electric vehicle programs, affirmed “that we have not cut any of our spending or activities around the vehicles like the Cadillac Lyriq and Hummer EV. We’re absolutely on time. We haven’t lost a beat.”

Ford is releasing the Mustang Mach-E SUV later this year and the long-anticipated electric F-150 pickup in 2022. Ford has invested more than $500 million into startup Rivian to accelerate EV development for Ford and Lincoln brands. Ford has also entered into a partnership with Volkswagen to use VW’s battery technology in an EV slated for 2023.

Volkswagen is investing $37 Billion in its EV program, more than any other manufacturer to date. Across its family of brands that include Audi and Porsche, VW intends to manufacture 1.5 million EVs annually by 2025. But VW’s ambitions go beyond vehicles. “By 2025, we will have 350-gigawatt hours worth of energy storage at our disposal through our electric car fleet. Between 2025 and 2030, this will grow to 1 terawatt-hours worth of storage,” chief strategist Michael Jost recently told journalists in Berlin. “That’s more energy than is currently generated by all the hydroelectric power stations in the world. We can guarantee that energy will be used and stored, and this will be a new area of business.”

Volvo plans to launch an EV every year for the next five years and sell them aggressively. Volvo wants EVs to represent 50% of its global sales by 2025. Regarding COVID-19 impact, at a recent Financial Times global digital conference, CEO Häkan Samuelsson said, “Electrification will go faster. I think it would be naive to believe after some months, everything will return to normal, and our customers will come back into a showroom asking for diesel cars – they will ask even more for electric cars. And that is speeding up.”

Nissan plans to bring eight new EV models to market by 2023. To shore up competitiveness, Nissan, Renault, and Mitsubishi Motors plan to strengthen their alliance by jointly developing EVs. What’s most notable with Nissan is that its EV growth plan focuses on the Chinese and European markets where national climate change and pollution reduction policies are accelerating transportation electrification.

POLICIES MATTER

It’s not a matter of if but when and where EVs will dominate auto markets. In Europe and China, the transition to electric transportation is outpacing the U.S., in large part due to increasingly stringent climate change and air pollution regulations. Automakers are going to focus on the markets where the conditions are best suited for growth. If the U.S. wants to access the economic, climate, and human health benefits transportation electrification delivers and wants to maintain global EV technology development competitiveness, pro-EV policies are needed.

In the absence of federal action, many states are stepping up to improve market conditions. Just this week, Nevada became the 15th state to adopt Clean Car Standards, setting strict transportation emissions requirements that will result in automakers increasing consumer access to EVs. The 15 clean car states represent 36% of the car-buying market and create a regulatory patchwork across the country that creates challenges for automakers.

Automakers are doing their job investing in and bringing to market lower-cost and longer-range EVs. Consumers are signaling a desire for a cleaner, lower-cost, more convenient, and better-performing driving experience. But in the end, federal leadership, as we see in Europe and China, is needed. EVs will kick gas, and American consumers don’t want to be left behind.

The Southern Alliance for Clean Energy’s Electrify the South campaign advocates for a shift to clean, electric transportation throughout the Southeast. Visit Electrify theSouth.org to learn more and connect with us.