Read The Full Article On: Stocknews

The stock market stabilized last week, after a recovery that was little more than a stimulus fueled mirage. The meltdown in the crude oil market last week offset the flood of central bank stimulus. The price of oil fell to its lowest level in history. Market participants were still trying to wrap their heads around the move that took the price of expiring May futures to a low of over negative $40 per barrel in a sign that the deflationary spiral that continues to grip markets.

Meanwhile, a leading Wall Street financial institution put out a sell recommendation on Apple Inc. (AAPL), the company that has an unparalleled franchise in the smartphone business and offers a suite of other popular products. When it comes to another high-flying company over the past months, the lowest oil prices in history could destroy at least part of the value proposition for electric automobiles, but Tesla Inc. (TSLA) shares were steady.

AAPL and TSLA had been market darlings. Both closed last week at levels that reflect lots of uncertainty. The mirage of a recovery in stocks dissipated over the past week, but stimulus continues to prop up the overall market.

A new world after the virus

The tidal wave of selling in the stock market ended in the middle of March as central banks pumped unprecedented levels of liquidity into the global financial system. At the same time, governments arranged for fiscal stimulus programs to buy time while scientists scramble for effective therapy for Coronavirus that will reduce the need for social distancing. The US and global economies remained in a self-induced coma, but the stock market continues to look to the future with optimism.

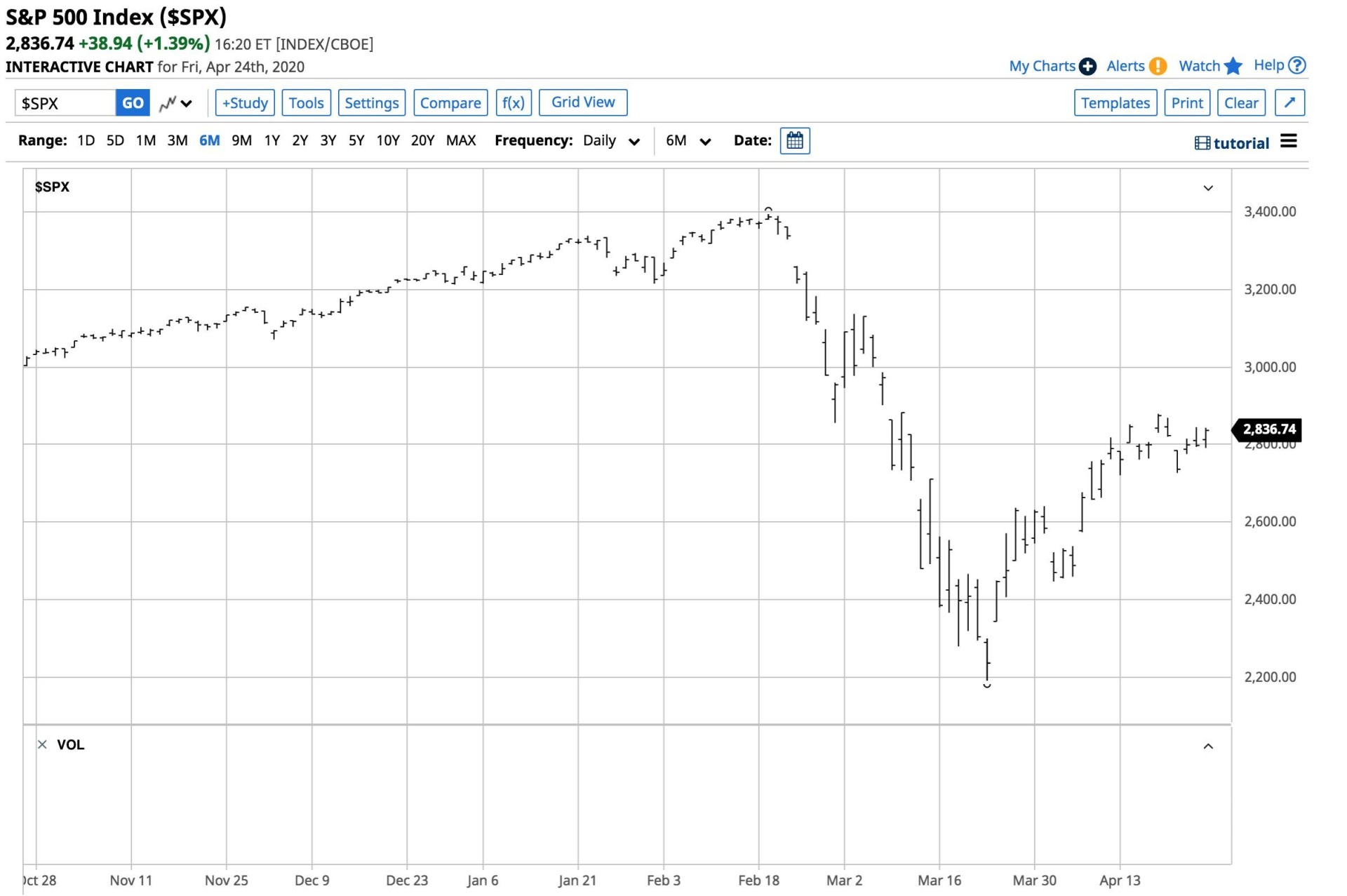

(Source: Barchart)

The chart of the S&P 500 index shows the decline from the record high of 3,393.52 on February 19 to a low of 2,191.86 on March 23, a drop of 35.4%. The close on Friday, April 24, at 2,836.74 was 29.4% above the March low and 16.4% below the February peak. The index was only 44.05 points above the midpoint of the trading range. Both AAPL and TSLA were both in the same position, trading above the midpoint of the recent wide trading range as of the end of last week.

Goldman sours on Apple

On Friday, April 17, Goldman Sachs cut its price target on AAPL shares from $250 to $233 per share. The move came after the company reduced its earnings estimates for the third time since February 17. Goldman analysts believe that the aftermath of the global pandemic will weigh on iPhone sales.

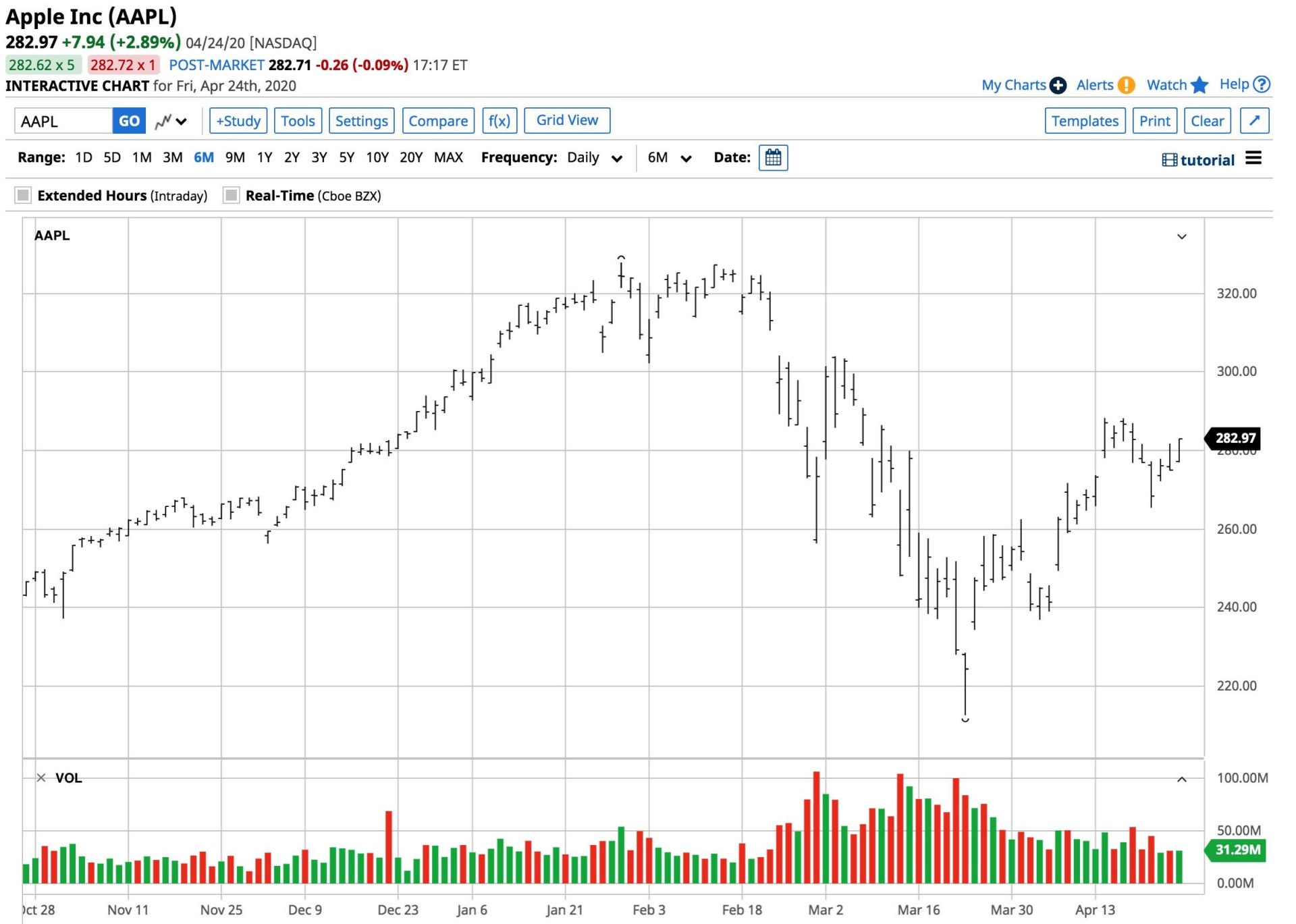

(Source: Barchart)

As the chart shows, AAPL shares closed at $282.80 on April 17 and $282.97 on April 24. Goldman Sachs wields lots of power in markets, which could encourage selling in the shares. Their price target at $233 is 17.6% below the market price at the end of last week.

Since the stock market is juiced on the back of stimulus, unemployment levels have exploded, and parts of the economy remain in a coma, the potential for downdrafts in the stock market is high. However, AAPL’s franchise in the smartphone business leads me to believe that at lower levels, the stock offers excellent value. Moreover, the company’s cash balances put it in a strong position when it comes to acquisitions of other businesses at bargain-basement prices over the coming weeks and months during this challenging period. AAPL was trading at a price that was just slightly below its closing level from the end of 2019 which was at $293.65 per share.

Tesla and the lowest oil prices in years

TSLA faces other problems that are related to the energy markets and the company’s debt levels.

(Source: Barchart)

TSLA at $725.15 was $306.82 above its closing price at the end of 2019. Lower oil and gasoline prices could weigh on the price of the stock, and mountains of debt could cause downdrafts in its share price. TSLA remains a bet on its founder, Elon Musk, who is a modern-day Thomas Edison. Time will tell if that is enough to support the stock and further gains in these unprecedented times.

Coronavirus is likely to usher in a new era of consumerism when it comes to the demand for products. Given a choice between the two popular stocks, on price weakness, I prefer AAPL because of the company’s cash position, and its franchise. People are learning to do more with less in the current environment. Technology is likely to emerge as the most robust sector. It is time to be highly selective in the stock market. I’d rather own AAPL than TSLA at their current share prices, and I’d be a buyer of Tim Cook’s company before Elon Musk’s if selling returns to the stock market.