Read The Full Article On: Fool

Battleground stocks come in all flavors and industries, so perhaps this isn’t the first time you’ve seen Tesla (NASDAQ:TSLA) and Shopify (NYSE:SHOP) singled out in the same sentence — or even headline. They are some of the more popular growth stocks for risk-tolerant investors.

They are speedsters within their industries. They are both overvalued by most conventional measuring sticks. They are volatile, heavily shorted, and not for the weak of heart.

However, they are both also ultimately winners. Both stocks hit all-time highs last month, and despite the market’s brutal sell-off in recent weeks, Shopify is still nearly an eight-bagger since the start of 2017. Tesla investors haven’t fared so well since that particular starting line, but they have still handily beaten the market with a stock that has more than doubled in that time.

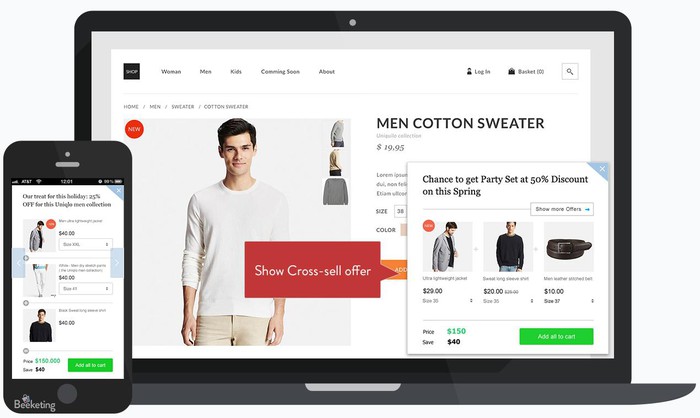

IMAGE SOURCE: SHOPIFY.

Shifting into drive

Tesla and Shopify are rattling their respective worlds. Tesla has disrupted the automotive market, an industry that is otherwise in a state of decline. Shopify toils away in the more buoyant e-commerce segment, but it’s growing considerably faster than other online merchant platforms.

Growth has decelerated at both companies over the past year, but they are still clocking in with strong long-term growth rates. The three-year compound annual revenue growth rate at Tesla is 52%, compared to flattish rates at the country’s two leading automakers. Shopify is growing even faster, with a three-year annualized rate of nearly 60% on the top line.

Neither stock is cheap. Tesla trades at an enterprise value that is 3.6 times its trailing revenue. This may not seem like a steep multiple, but it’s huge in the big-ticket and low-margin automotive industry. Tesla’s multiple is roughly four times that of the country’s two largest car manufacturers.

Shopify fetches an enterprise value that is 23 times last year’s revenue, nearly seven times the multiple of the world’s leading online retailer. Tesla and Shopify are just starting to come into their own in terms of profitability, but even forward multiples are high for both investments.

Investors haven’t flinched when it comes to paying up for a piece of the action. Tesla and Shopify are reshaping their industries. Tesla’s role in making electric cars aspirational is well known, and it’s on the leading edge of autonomous driving. Shopify is arming hundreds of thousands of aspiring and established merchants with the tools to seamlessly sell to the world.

Tesla’s popularity is growing faster than its revenue, as consumer appetite has shifted to the cheaper Model 3 last year and now the equally affordable Model Y. Shopify’s business continues to pick up steam, with the platform operator able to pitch more related services to its growing number of merchant accounts.

Value investors may wince at the stiff valuations of the two stocks, but they also felt that way a couple of years ago, and we see how well that worked out for shareholders. Tesla and Shopify are market-thumping growth stocks, rocking their industries and defying their naysayers on the way higher.