Read The Full Article On: Bridgemi

As Michigan leaders continue to debate ways to address the state’s poor road conditions, it’s important that they consider road funding solutions that won’t penalize those who are driving the next generation of electric vehicles.

The Ecology Center recently released a new report offering original research and policy recommendations for a road funding model that promotes a clean transportation shift benefitting the health of Michigan’s environment, people and economy.

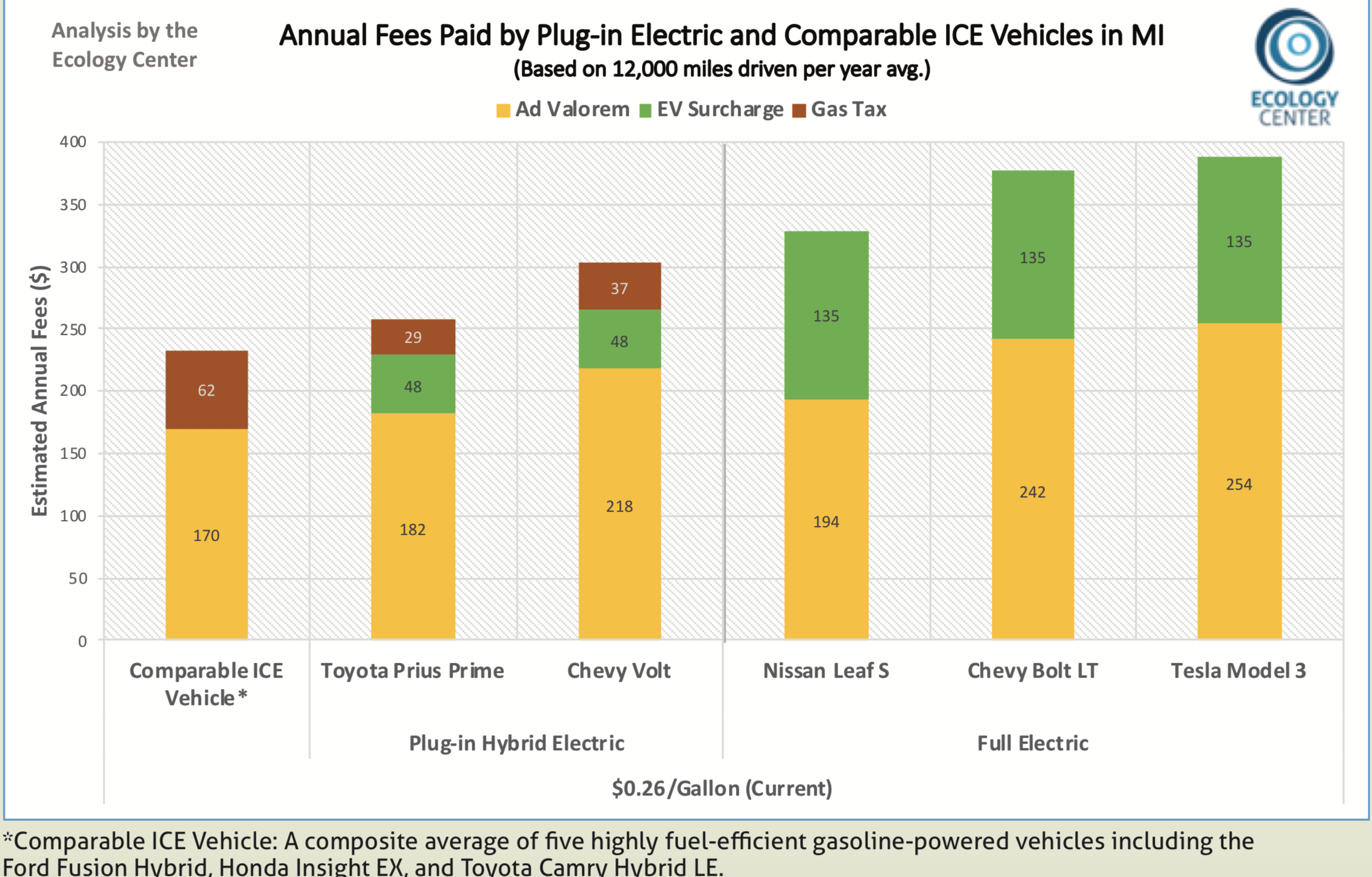

The Ecology Center’s research shows that battery electric and plug-in hybrid vehicle owners are charged more in taxes and fees than owners of comparable gasoline-powered cars and trucks.

Plug-in vehicle drivers currently pay between $300 and $390 in upfront vehicle registration fees each year, about twice as much as comparable vehicles. Since these vehicles represent fewer than 1 percent of cars and trucks on the road today, the disproportionately high fees accomplish very little to improve our state’s roads and bridges. However, the fees do make cleaner cars less appealing and accessible for cost-conscious consumers.

Total fees and taxes are as much as 67 percent higher for electric vehicles (EVs) and 30 percent higher for plug-in hybrid electric vehicles (PHEV) than their internal combustion counterparts. A typical EV driver currently pays $90-$160 more each year than the driver of a comparable gasoline-powered car or truck, and someone with a PHEV pays $20-$70 more.

Because the EV surcharge is tethered to the gas tax, these disparities will grow even wider if gas taxes are increased without a change to the current surcharge formula.

While compromise legislation raised gas taxes and registration fees across the board in 2015, it also added annual surcharges for plug-in electric and hybrid vehicles, intended to make up for lost gas tax revenue. Unfortunately, the 2015 adjustments weren’t enough to solve long-term funding shortfalls, and they imposed a calculation formula that overburdens EV drivers.

Because plug-in vehicle owners pay more for their cars up front, they already pay higher sales taxes and registration fees, even before the electric vehicle registration surcharge. These higher registration fees largely make up for any lost gasoline tax revenues, even before the surcharge.

Electric vehicles should pay their fair share of transportation system costs, but this means the additional fees they pay should be lowered to a level comparable with what efficient internal combustion engine vehicles pay.

“Paying Their Fair Share” proposes several options for legislators to improve the current situation. One straightforward stopgap measure would be to lower PHEV and EV fees to more equitable rates, or at least to freeze them at their current rates. A better, more equitable approach in the short or medium-term would be to replace a single fixed EV surcharge with differentiated fees based on the total road funding fees and taxes that comparable gasoline vehicles pay.

Longer-term, additional solutions will need to be explored to address anticipated increases in vehicle fuel-efficiency overall, as well as to reflect the actual mileage that plug-in vehicles travel each year.

Given Michigan’s stake in the future of the auto industry, which is increasingly electric, it is critical that our state take a more nuanced and fair approach to levying fees on these vehicles. If we want the rest of the world to buy the advanced technology vehicles that our auto sector is producing, we need to guide the way in developing the advanced vehicle policies that will help to accelerate their adoption.