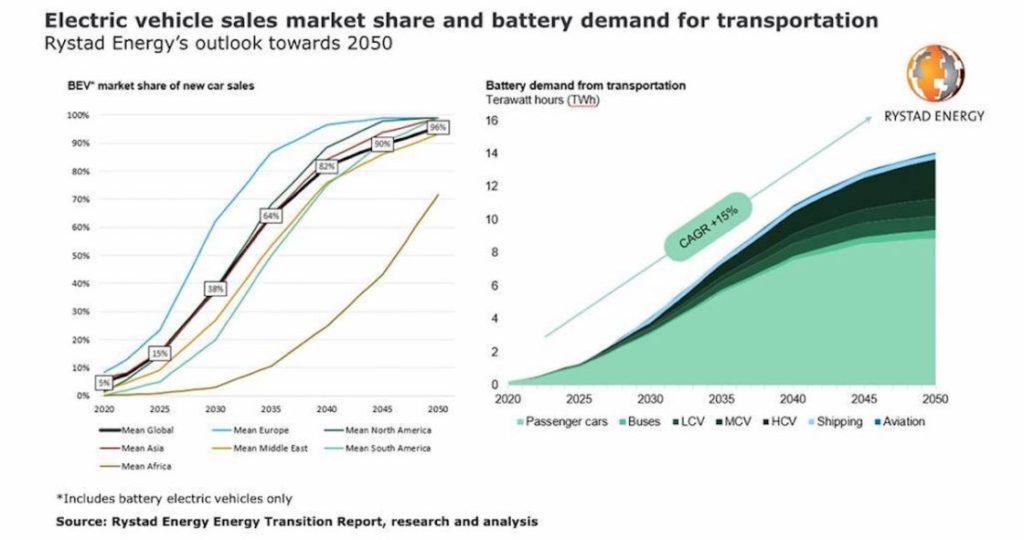

According to a study carried out by Rystad Energy, in 2033, half of the cars sold worldwide will be electric, while by 2050, they will account for almost the entire market. Although in 2020, this type of vehicle had a total share of 4.6%, this figure will quadruple by 2026.

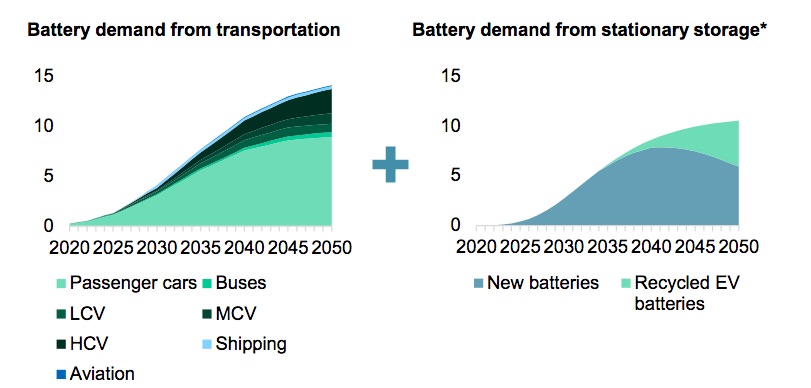

This, of course, will go hand in hand with an increase in battery production capacity: while in 2020, cells for electric cars represented 0.23 TWh globally, in 2024, they will increase to 1 TWh. In 2030 it should have reached 4 TWh, and in 2040 10 TWh, while in 2050, the industry will stabilize at about 14 TWh per year.

By then, cars will account for 70% of the world’s demand for batteries. Those responsible for the report point out that Europe will be the region that will lead this transition. At the opposite pole, we will find Africa, the only continent whereby 2050, a small percentage of thermal vehicles will still be sold.

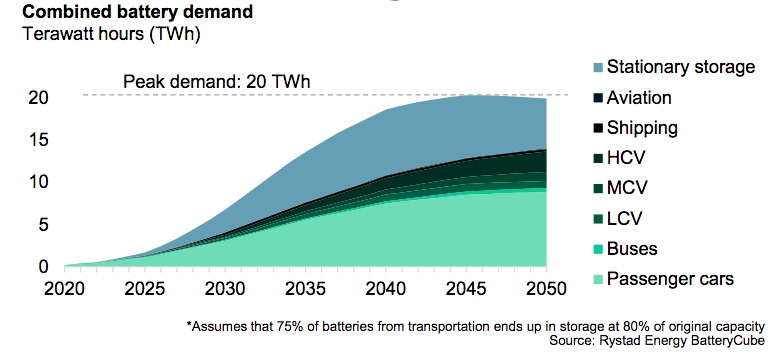

If we focus on batteries for power grids, we will see that the study indicates that this sector will reach an annual demand of 0.4 TWh in 2025 and 2.7 TWh in 2030, stabilizing at 10 TWh by mid-2040. Besides, a significant part of the demand (precisely 75%) will be covered with reused vehicle batteries, which will be 90% recycled once their second helpful life ends.

When it comes to industries such as aviation or shipping, Marius Foss (senior vice president and director of global energy systems at Rystad Energy) predicts that the use of batteries will not begin to go mainstream until the next decade. Also, the executive affirms that they will only become one of the pillars of air transport if the sector to create smaller but more numerous aircraft.

“In the maritime transport sector, batteries will be used mainly in small vessels and in auxiliary systems for large vessels. This could change with significant technological advances, for example, in lithium-air batteries. However, these types of advances do not seem imminent. Aviation is still at least 10-15 years away from a significant rebound in commercial electric flight.”

“All these projections will be closely linked to a constant reduction in cell production costs. On the other hand, it is also claimed that alternative technologies such as hydrogen will only succeed if batteries fail. “A major advantage […] is the fact that battery manufacturers only rely on themselves to increase supply […]. On the other hand, Hydrogen depends on political changes and the evolution of costs in other parts of the value chain. To be successful, you essentially need the batteries to fail.”