Read The Full Article On: Investorplace

Nio stock could rise another 63% this year to $92 based on its growth and a comparison with Tesla stock

Nio (NYSE:NIO) posted fantastic growth on Jan. 3 in its fourth-quarter and 2020 full-year electric vehicle (EV) deliveries. After that strong start, I believe that Nio stock is likely to have a very good 2021.

Source: Andy Feng / Shutterstock.com

Last month I projected that Nio would double to about $100. At the time, the stock was at $43.50. It has since risen to $56.27, up 29.35%, although it is down from a peak of $62.70 on Jan. 11.

Nevertheless, I still feel that Nio stock is worth around $92 per share, or 63% above today’s price. This article will go into the specifics of how I estimate that price.

Impressive Q4 Deliveries

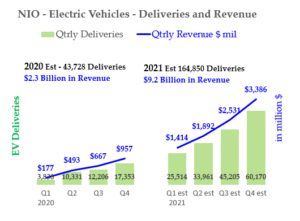

Last month I forecast that Nio would deliver 15,902 EVs during Q4. It turns out that the company did much better. It delivered 17,353, which was 121% more than last year.

More importantly, this 17,353 delivery number represents a quarterly growth of 42.2% over the prior quarter. This was much better than the 30.3% growth I had forecast.

Moreover, this allows me to raise my forecast for 2021. I now project that Nio will make and deliver 164,850 EVs. This is substantially higher than the 130,712 I predicted last month for 2021.

Click to EnlargeSource: Mark R. Hake, CFA

As a result, my estimate for 2021 sales is now much higher at $9.2 billion. This is well above the $7.3 billion I forecast for 2021 last month.

It is also based on the average selling prices from the last quarter. It also includes a 1% bump in Q4 and a 0.5% increase in each quarter during 2021.

You can see these projections in the chart at the right.

What This Means For Nio Stock

Using this information, I estimate Nio will produce 164,850 EVs in 2021 with total revenue of $9.3 billion. We can use that information to derive an estimate for Nio’s value.

For example, Tesla (NASDAQ:TSLA) produced about 500,000 EVs this year and is on track to deliver at least 800,000 EVs this year. Some say it will be closer to 1 million.

Let’s estimate that the number comes to about 850,000 for Tesla. That means Nio’s 164,850 EV deliveries will be 19.39% of Tesla’s. Therefore at some point this year, we might expect that Nio’s market capitalization might equal 19% or so of Tesla’s now.

For example, Nio has a market cap of $95.12 billion right now. Tesla’s market cap is $800.1 billion, at $826.16 per share. This means that Nio is at 11.9% of Tesla’s market cap.

This implies that at 19.39% of $800.1 billion, Nio’s market cap should hit $155.14 billion sometime this year. That represents a potential gain of 63.1% or so (i.e., $155 billion divided by $95.12 billion).

In other words, Nio stock is worth 63.1% more, or $91.77 per share.

Other Ways To Value Nio

Keep in mind that this is a very crude and rough way of measuring the value of Nio stock. For example, I did not take into account any ancillary assets that Tesla owns, which would make its value worth more than its price today. In other words, this model just assumes TSLA stock is trading where it should be.

In addition, I did not even compare the revenues, profits, market share or any kind of fundamentals including balance sheet differences in measuring Nio’s value.

For example, it might be more appropriate to measure Nio based on its price-to-sales ratio or enterprise value-to-sales ratio vs. TSLA stock. Once both companies produce their Q4 numbers we can refine this valuation approach.

Nevertheless, I still think that it shows that Nio is basically undervalued, especially when compared to Tesla’s existing valuation. This should be helpful to investors who might want to diversify their ownership in EV stocks to more than just owning Tesla stock.