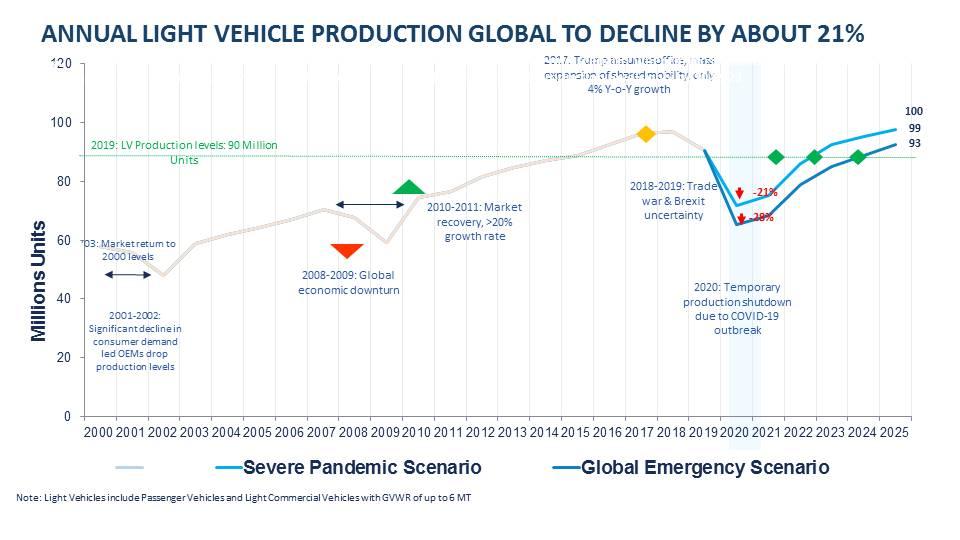

The consultancy Frost & Sullivan has made an estimate of the evolution of the automobile market in the world where they have projected the fall as well as the recovery curve that this industry will have. A report that is divided into two scenarios, one more positive and the other more negative, which show us the severe depression that the sector will experience in the coming years.

To make the estimate, they have used real-time data and the history of sales in the last two decades where we can see declines due to crises such as the 2008 economic crisis or the impact of Brexit. A graph that draws us two scenarios: a severe pandemic and a global emergency with results ranging from gradual recovery to the recession, respectively.

The first scenario is the so-called “severe pandemic” where bottlenecks in the supply chain will not allow manufacturing plants to achieve full production capacity in the short term. Most countries will resume only partial vehicle production in mid-June before increasing to full capacity in August. As a result, I anticipate that annual passenger car production volumes will decrease approximately 21% from 2019 levels before picking up pace in 2021 and finally returning to 2019 levels by 2023.

In the global emergency scenario, the most negative, the pandemic remains uncontrolled in the coming months resulting in a continuous slowdown in production, high levels of unemployment, and a sharp drop in demand. Efforts to “get back to normal” give way to the adaptation to the “new normal,” with digital strategies to try to solve the need for social distance both in sales and throughout the supply chain. The mobility industry will accelerate in a recessive environment, reaching 2019 levels in four or five years.

From the consultancy, they have also delved into the data to know how this crisis will affect the electric car sector, which augurs a lesser decline and a faster recovery. Something that will have a lot to do with the rebound that the leading world market for this type of vehicle is having, China, where sales are back to normal.

Furthermore, this sector is more prone to technological advances. Brands such as Tesla have spent years developing and reinforcing the sale and delivery of vehicles without customer contact. All online, which has allowed them to overcome this hard market decline with more solvency.

We can add the introduction or return of purchase aids in some of the main markets, such as Germany or China itself, and the result for the consultant will be a market that will recover more quickly. The estimate being a return to the positive path in the third quarter of the same year 2020.

But this scenario also has its risks since it is estimated that the best economic position of Chinese manufacturers will allow them to take advantage of the disaster in the European market where brands have stopped their production in a disorganized way. This causing chaos among supplying companies—the perfect breeding ground for the Chinese to expand borders faster than expected.

A post-coronavirus scenario where we will see cheap oil, the expansion of individual shared transport services, such as bike and motorcycle sharing systems, as well as increased demand for online vehicle sales that will force brands to give a definitive step forward in this regard.