Read The Full Article On: Kfgo

TOKYO (Reuters) – Japan’s Nidec Corp <6594.T> plans to more than treble its revenue over the next five years by focusing on electric vehicle powertrains and buying specialists in motor technologies, two people familiar with the matter told Reuters.

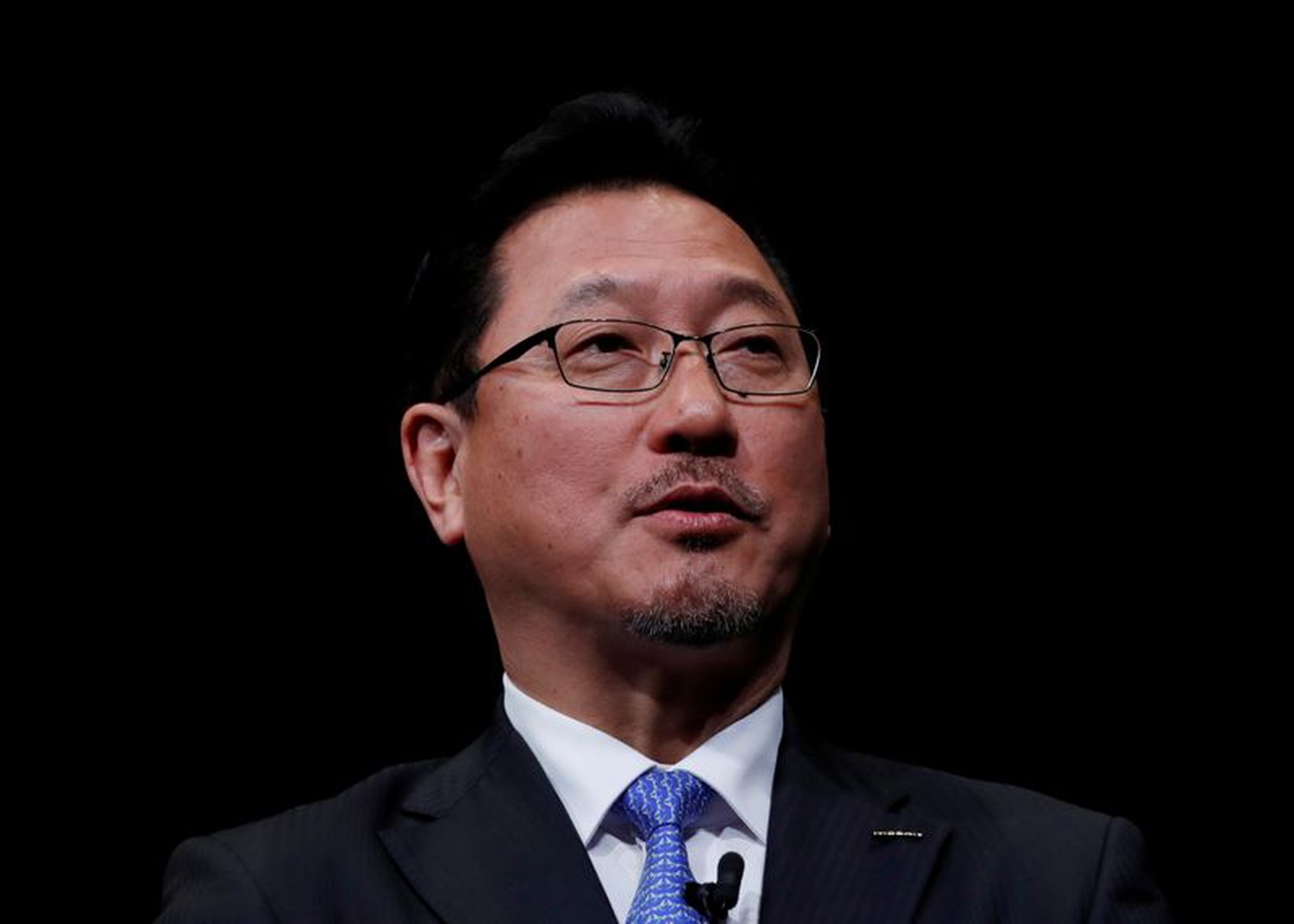

The world’s leading maker of precision motors which supplies parts for Apple’s iPhones is expected to detail its plans as soon as Tuesday when it will name former Nissan Motor <7201.T> executive Jun Seki as president, the sources said.

The new strategy shows how the Kyoto-based company wants to play a bigger role in the auto industry as electric vehicle (EV) production takes off, after slowdowns in demand for motors in markets such as cellphones have weighed on its sales.

“The EV motor system is key to our growth strategy,” said one of the sources, a Nidec insider, referring to integrated EV powertrain systems commonly known as e-axles – technology that incorporates motors, power electronics and transmissions.

“The e-axle market is going to be big, but it is only one half of our twin-pillar growth strategy,” the person said. “The other big key to growth is in mergers and acquisitions of other motor-related technologies.”

The sources declined to be identified because the information is not yet public. Nidec declined to comment.

Nidec’s plan is to boost annual revenue to 5 trillion yen ($46 billion) by 2025, the sources said, from 1.55 trillion yen forecast for its financial year ending in March.

Founder and CEO Shigenobu Nagamori has in the past alluded to a company vision of 10 trillion yen in revenue by 2030 but has not mapped out specific steps to achieve such a target.

Seki, who told Reuters in December he was leaving Nissan for Nidec, is expected to help Nagamori lead the revenue push.

Nidec has long been synonymous with Nagamori, who started out in 1973 with three workers in a Kyoto shed and built a global powerhouse with more than 100,000 employees, making motors for “everything that spins and moves”.

TECH LABS AND STARTUPS

Nidec already supplies e-axles to automakers such as China’s GAC Motor <601238.SS> and France’s Peugeot SA . Rival e-axle makers include Germany’s Bosch and ZF Friedrichshafen and Toyota <7203.T> affiliate BluE Nexus, among others.

Nidec wants to significantly improve the quality and performance of its e-axles so they become “more efficient, smaller and thus cheaper,” one of the sources said.

To meet its growth targets, though, it will have to boost sales of motors beyond those used in EVs and is looking for mergers and acquisitions (M&A), the sources said.

From home appliances to cellphones to laptops to other devices, “Nidec will continue to be active in M&A and gobble up attractive tech labs and startups and companies, even if they are small,” one of the sources said.

Nagamori told reporters this month that Nidec could spend 500 billion yen on its growth strategy, including technology acquisitions.

It may use the money to acquire new e-axle technology and know-how to improve its existing products, the sources said, adding that the EV focus was fuelled by a belief more and more automakers will replace gasoline vehicles with electric cars.

While pure battery-powered vehicles are just a sliver of global production now, they are expected to make up 5.6% of total production by 2026, according to AutoForecast Solutions.

The research firm estimated production of all EVs, including gasoline hybrids, will reach 13.3 million in 2026 and account for 13.6% of total global car production of 98.1 million.

Industry officials and experts say a key challenge facing Nidec and rival e-axle producers will be to get costs down to roughly $1,500 or below from the roughly $2,000 they cost now.

Nidec’s confidence in the business stems from a view that automakers will behave more like smartphone or laptop producers as they phase out their reliance on the combustion engine.

It believes that EVs – like laptops and smartphones – will be designed with key components that are “as commoditised as Intel chips for laptops”, one of the sources said.

($1 = 109.7000 yen)