Read The Full Article On: Yahoo Finance

Although global economic uncertainties have mounted amid the COVID-19 outbreak, we expect structural EV demand growth to remain intact. In the short term, demand for EVs will likely grow more rapidly than demand for conventional vehicles. Furthermore, major automakers, including Volkswagen, are unlikely to change their EV strategies.

In 2020-2021, we believe global EV demand will primarily come from Europe, where new EV model launches should expand despite uncertainties over the easing of environmental regulations. In the US, growth is likely to be driven by Tesla.

China should also exhibit robust demand, supported by the extension of subsidies. In particular, as Tesla gains a bigger foothold in the country, global and local automakers will likely take more aggressive action. Through this process, we believe China will transition from a subsidy-driven to a private demand-driven EV market.

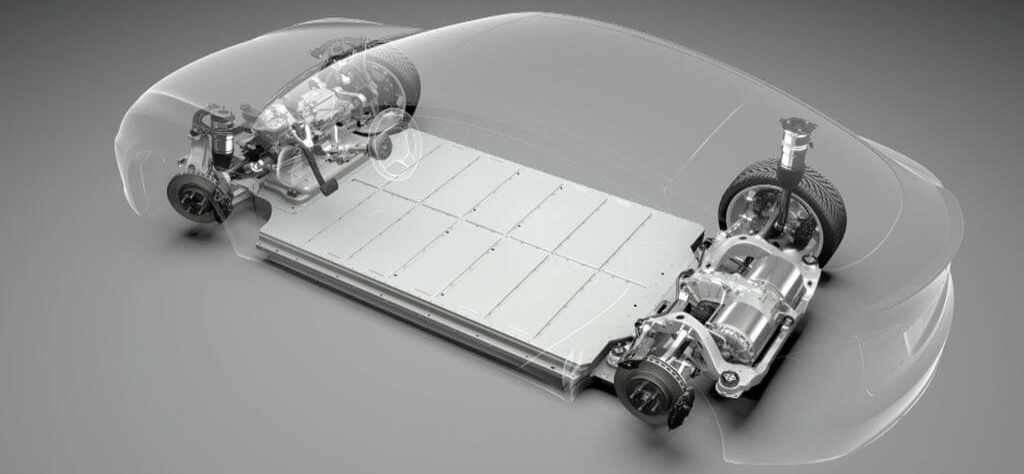

In the short term, we think the gap in EV competitiveness among automakers will widen amid the economic slowdown. EV competitiveness comes mainly from the adoption of a dedicated platform, economies of scale, and improved management in batteries. As such, we believe capital power and investments will likely grow in importance.

In 2022-23, we expect battery prices to decline. For its Chinese models, Tesla plans to adopt cell-to-pack battery technology with lithium iron phosphate (LFP) cathodes. LFP batteries have lower energy density than nickel manganese cobalt (NCM) batteries, but are also 20% cheaper.

Meanwhile, LG Chem plans to adopt nickel, cobalt, manganese, and aluminum (NCMA) cathodes (more than 80% nickel content) from 2022-23 and apply long cell technology to increase battery energy density by at least 20%. Samsung SDI is working on improving energy density more than 20% by applying lithium nickel cobalt aluminum oxide (NCA) cathodes to its prismatic batteries. Thanks to these efforts, battery cell costs are anticipated to fall from US$130/kWh currently to around US$100/kWh in 2022-23.

In addition to lower battery costs, overall EV production costs are also likely to fall sharply, aided by fixed cost savings from scale effects. Volkswagen is believed to have invested heavily in developing its EV platform, the modular electric drive matrix (MEB), but the development cost per unit is projected to decline significantly as production volume ramps up.

Assuming platform development costs at W2tr, the cost per unit should fall sharply as Volkswagen’s EV sales volume grows (from an estimated 400,000-500,000 units globally in 2020 to 1.5mn units in 2023 and 3mn units in 2025). Assembly line productivity is also likely to improve 30% through the EV platform, leading to significant fixed cost savings per unit. Thus, by 2023, we believe EVs could approach price parity with gas-powered vehicles, even without fuel cost savings effects.

With more automakers aiming to market cheaper, longer-range plug-in cars, demand for lithium-ion automotive batteries is expected rise. This report analyzes the markets for electric vehicles and EV batteries by type and geographic region. Other sectors analyzed are anode and cathode materials, and separators. Supply/demand of raw materials including lithium, cobalt, and nickel are detailed and forecast.

Key Topics Covered:

Chapter 1 Introduction

Chapter 2 Global EV and EV Battery Market Outlook

2.1 EV Market

2.2 EV Batteries

2.2.1 EV Battery Market Forecast

2.2.2 EV Battery Energy Density

2.2.3 EV Battery Cell Price

2.2.4 EV Battery Market Share

2.2.5 Rise of China

2.2.5.1 Aggressive EV Battery Expansion

2.2.5.2 Chinese Battery Technology

2.2.6 Future Batteries

2.2.6.1 Lithium-air (Li-air)

2.2.6.2 Lithium-metal (Li-metal)

2.2.6.3 Solid-State Lithium

2.2.6.4 Lithium-sulfur (Li-S)

2.2.6.5 Sodium-ion (Na-ion)

Chapter 3 Chinese EV and EV Battery Market Outlook

3.1 China EV Market

3.2 China EV Batteries

3.2.1 China EV Battery Market Forecast

3.2.2 Rise of China

3.2.2.1 Aggressive EV Battery Expansion

3.2.2.2 Chinese Battery Technology

3.2.2.3 EV Battery Overcapacity

Chapter 4 Cathode Material Analysis

4.1 Introduction

4.1.1 Cathode Material Costs

4.1.2 Cathode Materials And Battery Types

4.1.2.1 LCO (Lithium Cobalt Oxide) Cathodes

4.1.2.2 NCM (Nickel Cobalt Manganese) Cathodes

4.1.2.3 LMO (Lithium Manganese Oxide) Cathodes

4.1.2.4 LFP (Lithium Iron Phosphate) Cathodes

4.1.2.5 NCA (Nickel Cobalt Aluminum) Cathodes

4.2 Lithium

4.2.1 Lithium Prices

4.2.2 Lithium Supply/Demand

4.2.3 Top Lithium-Producing Countries

4.2.4 Top Lithium-Producing Producers

4.3 Cobalt

4.3.1 Cobalt Prices

4.3.2 Cobalt Supply/Demand

4.3.3 Top Cobalt-Producing Countries

4.3.4 Top Cobalt-Producing Producers

4.4 Nickel/Manganese

Chapter 5 Global Anode, Electrolyte, And Separator Material Analysis

5.1 Overview

5.2 Global Anode Market

5.3 Global Separator (Membrane) Market

5.4 Global Electrolytes Market

Chapter 6 China Anode, Electrolyte, And Separator Material Analysis

6.1 Overview

6.2 China Anode Market

6.3 China Separator (Membrane) Market

6.4 China Electrolytes Market

Chapter 7 Supplier Profiles and Strategies

- Aekyung Chemical

- Aleees

- Asahi Kasei

- B&M

- BASF

- BTR New Energy Materials

- BNE

- Cangzhou Mingzhu

- Central Glass

- Do-Fluoride Chemical

- Easpring

- Ecopro

- Foshan Jinhui Hi-tech Optoelectronic Material

- Guangzhou Tinci Materials Technology

- Guotai-Huarong

- Hitachi Chemical

- Huiqiang New Energy

- Hunan Changyuan Lico

- Idemitsu Kosan

- JFE Chemical

- Johnson Matthey

- Kureha

- L&F

- Mingzhu

- Mitsubishi Chemical

- Nichia

- Ningbo Jinhe New Materials

- Posco

- Pulead Technology Industry

- Reshine

- Shenzhen Senior Technology

- ShanShan

- Shenzhen Capchem Technology

- SK Innovation

- Shinzoom

- Sinuo

- Soulbrain

- Stella Chemifa

- Sumitomo Metal Mining

- Tanaka Chemical

- Tangray

- Teijin

- Toray Battery

- Ube Industries

- Umicore

- W-Scope

- Xiamen Tungsten

- Xinxiang Zhongke Science and Technology

- XTC New Energy Materials

- Zeto

- Zhuhai Smoothway Electronic Materials

- Zichen

Chapter 8 Battery Company Profiles and Strategies

- AESC

- BYD

- Beijing National Battery Technology

- CALB

- Camel Group Co

- CATL

- Cham Battery Technology Co

- Chaowei Power Holdings Limited

- CITIC Guo’An Mengguli (MGL)

- CNSG Anhui Hong Sifang Co

- Coslight

- DLG Power Battery

- Do-Fluoride (Jiaozuo) New Energy Technology

- EVE Energy Co., Ltd.

- Farasis Energy (Ganzhou) Co., Ltd.

- First New Energy Co. Ltd

- Great Power Energy Technology Co., Ltd

- Guoxuan Hi-Tech

- Harbin Coslight Power Co., Ltd.

- Henan Lithium Power Source Co

- Henan Xintaihang

- Highstar Battery

- Huanyu New Energy Technology Co., Ltd.

- Hunan Copower EV Battery Co., Ltd

- Jiangsu Tenpower

- Jiangsu Zhihang New Energy Co., Ltd.

- Kokam Co., Ltd

- LG Chem

- Lithium Energy Japan

- Mcnair New Energy Co., Ltd

- Melsen Power

- Microvast Power Systems Co., Ltd.

- Narada Power Source Co., Ltd.

- Ningbo CRRC New Energy Technology Co., Ltd.

- NorthVolt

- OptimumNano

- Panasonic

- Plylion Battery Co., Ltd.

- Primearth EV Energy Co., Ltd.

- Samsung SDI

- Shandong Forever New Energy

- Shandong Hengyu New Energy

- Shanghai CENAT New Energy Co., Ltd.

- Shenzhen BAK

- Sinopoly Battery

- Sinowatt

- SK Innovation

- Skyrich Power Co., Ltd.

- Supreme Power Systems Co., Ltd.

- Suzhou Youlion Battery Inc.

- Tianjin EV Energies Co., Ltd. (JEVE)

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Tianneng Power

- TerraE

- Tesla

- Tianjin EV Energies Co., Ltd. (JEVE)

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Tianneng Power

- Wanxiang-A123

- Wina Power

- Wuhu ETC Battery Limited

- Zhongdao Energy Co., Ltd.

- Zhuhai Yinlong New Energy Co., Ltd.

- Zhuoneng New Energy

- Zibo Guoli

- ZTT Energy Storage Technology Co., Ltd.